Luca Calarailli’s expertise in construction, combined with his passion for innovation in technology applications, provides valuable insights into the complexities of housing market trends and regional economic dynamics. Today, we delve into the challenges faced by communities in the Kootenays and potential implications for future development and investment.

Can you explain the reasons behind the near-zero housing starts in Trail in 2024?

The near-zero housing starts in Trail in 2024 can be attributed to several factors. One of the main reasons is the overall economic uncertainty affecting the region, largely influenced by broader national and global trends. This uncertainty has led to reduced investor confidence and caution among developers. Additionally, the rise in construction costs and stringent regulatory requirements have made it challenging to initiate new projects.

How does the decline in housing starts in Trail compare to trends seen in other Kootenay communities like Nelson and Cranbrook?

While Trail experienced a significant decline, similar trends were observed in Nelson and Cranbrook. In Nelson, housing starts fell sharply, indicating a comparable pullback in development activities. However, Cranbrook saw a different pattern, with detached homes dominating the starts, suggesting a shift in housing preferences or economic strategies unique to that area.

What factors contributed to the significant drop in new home construction in Nelson and Cranbrook?

Several factors contributed to the drop in new home construction in Nelson and Cranbrook. Economic pressures, including fluctuating interest rates and inflation, have likely deterred both developers and prospective homebuyers. Additionally, shifts in demand away from multi-unit residential options towards detached units have played a role in the observed trends.

Why are detached or semi-detached units dominating the housing starts in these communities?

Detached or semi-detached units are dominating the housing starts due to changing consumer preferences. Many buyers are seeking more spacious, private living environments, possibly driven by remote work trends or increased focus on lifestyle and wellness. Developers are responding to these preferences by focusing on such units, which aligns better with current market demands.

Has there been a notable decline in multi-unit residential development across the Kootenays? If so, why?

Yes, there has been a decline in multi-unit residential development, primarily due to economic factors and shifting buyer preferences. Higher construction and land costs for such developments have made them less appealing for investors. Additionally, increased demand for personal space has driven interest toward single-family homes or smaller scale builds.

How has overall investment in the Kootenays changed from previous years according to the CPABC report?

The CPABC report highlights a downturn in overall investment in the Kootenays, with the total value of major projects dropping slightly. This indicates reduced economic activity and hesitation among investors, likely fueled by ongoing trade disputes and market uncertainties. Such trends mark a departure from previous years where more aggressive investment strategies were observed.

What is the significance of the reported decrease in the total value of major projects in the Kootenays?

The decrease in the total value of major projects signals a slowing momentum in regional development and a potential shift in economic priorities. It suggests a reduced capacity for growth and expansion, impacting future employment opportunities and the broader economic health of the area. This decrease necessitates innovative approaches to attract and retain investment.

Can you elaborate on the types of projects currently underway in the Kootenays, and their potential impact on the local economy?

Projects currently underway include residential, resort, and accommodation developments, along with utilities projects. While these investments might stimulate short-term economic activity through job creation and infrastructure improvements, the lack of substantial industrial projects may limit long-term economic growth and diversification.

Why are residential, resort, and accommodation developments receiving a larger share of investment?

Investment in residential, resort, and accommodation developments is driven by the region’s appeal as a lifestyle destination. The natural beauty and recreational opportunities attract developers focused on tourism and residential expansion. This trend aligns with broader consumer interest in vacation and leisure activities in scenic locales.

How might the ongoing trade dispute with the United States affect new investments and economic prospects in the Kootenays?

The trade dispute poses risks by creating an environment of uncertainty, discouraging new investments. Industries dependent on cross-border exchanges face potential setbacks, which could ripple through the regional economy by affecting job stability and investment flows. It could also alter investor perceptions regarding the viability of long-term projects.

What industries in the Kootenays are most vulnerable to the impacts of the trade dispute?

Industries such as forestry, manufacturing, and agriculture are highly vulnerable, given their reliance on exports and trade relations with the United States. Disruptions in these sectors could lead to decreased production, job losses, and overall economic contraction, highlighting the need for strategic adaptation and diversification.

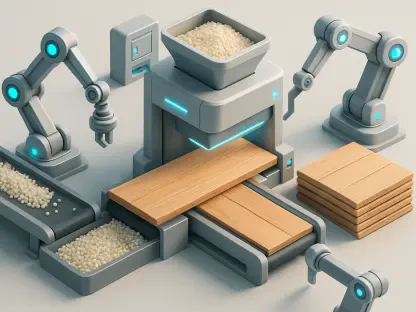

How are businesses in the Kootenays attempting to pivot or adapt in response to current economic challenges?

Businesses are exploring diversification strategies, such as investing in technology and innovation to enhance efficiency, and seeking new markets outside the U.S. for their exports. Additionally, there is a focus on community engagement and leveraging local resources to build resilient business models amidst economic volatility.

Can you describe the role of the CPABC and the purpose of their annual BC Check-Up: Invest report?

The CPABC plays a crucial role in analyzing economic trends and providing insights through the BC Check-Up: Invest report. This report serves as a comprehensive resource for tracking investment activity, housing construction, and regional economic indicators, assisting stakeholders in making informed decisions and strategizing future pathways.

What regional economic indicators are included in the CPABC’s report and why are they important?

The report includes indicators such as investment levels, housing starts, major project activities, and employment rates. These metrics are vital for understanding economic health, identifying opportunities for growth, and addressing potential challenges within the region. They provide a structured overview of how different sectors are performing.

How reliable is the data presented in the CPABC’s 2024 report, and what time frame does it cover?

The CPABC’s report is built on robust analysis using data up to the third quarter of 2024. While there’s always room for interpretation, the report’s reliability stems from detailed methodologies that ensure accuracy and relevance, providing a snapshot of current conditions and facilitating forward-looking economic planning.

Do you have any advice for our readers?

Understanding the interplay between economic trends and local dynamics is essential. Stay informed about regional developments, and consider how broader economic factors might influence personal or business decisions. Exploring innovative solutions and staying adaptable can help mitigate risks and capitalize on emerging opportunities.