Long Island’s commercial real estate market is experiencing a whirlwind of challenges and shifts amid evolving economic circumstances, as revealed at the recent “2025 State of the Market” event hosted by the Commercial and Industrial Brokers Society of Long Island. Experts from diverse sectors such as retail, industrial, office, banking, and construction convened to dissect emerging trends and forecast potential obstacles ahead. Primary among concerns is the surge in construction costs, exacerbated by tariffs that have heightened material prices by 20-25%. As highlighted by Devin Kulka of the Kulka Group, these tariffs are pushing industry players to explore local solutions to mitigate their impact. Concurrently, experts are monitoring the upcoming maturity of $900 billion in commercial real estate loans over the next two years, as outlined by Patti Kielawa from Hanover Bank, which is expected to deepen pressure on property owners. Despite these challenges, the Long Island CRE market is showing adaptability and resilience in certain sectors, offering promising opportunities for strategic growth.

Escalating Costs and Financing Challenges

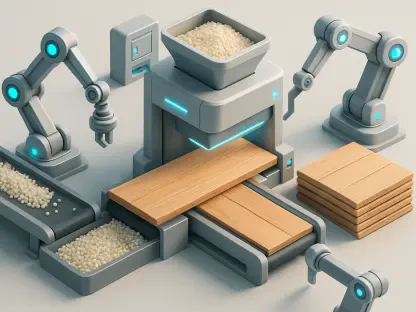

One of the most pressing issues facing Long Island’s commercial real estate sector is the significant rise in construction costs. The impact of tariffs, which have increased the price of materials by 20-25%, is being felt acutely by developers and builders across the region. Devin Kulka from the Kulka Group emphasizes the necessity of finding domestic solutions to combat these rising expenses and continue developments affordably. This issue is compounded by the looming maturity of $900 billion in commercial real estate loans within the next two years, a concern brought to light by Patti Kielawa from Hanover Bank. Such pressures demand keen attention from property owners and investors as they navigate financial landscapes influenced by fluctuating interest rates and the need for comprehensive cash flow analysis before committing to future projects. While financing remains tethered to the broader market conditions, industry stakeholders are actively pursuing strategies to safeguard investments and ensure sustainability despite the increasing costs of development and refinancing of existing loans.

Adapting to Office Sector Dynamics

The office sector on Long Island is showing signs of recovery, characterized by a gradual increase in the physical presence of employees in workplaces. Ray Ruiz of JLL highlights that the average return to office is at 3.74 days per week, a significant factor for market health. This return is essential, underscoring a trend toward the occupancy of Class A buildings, where vacancy rates remain comparatively low. For investors and managers in the office market, this preference signals opportunities for development and leasing strategies centered around premium spaces that promise higher demand due to their location and amenities. The evolution within the sector suggests a shift toward creating environments that cater to hybrid work models while fostering collaborative, technologically enabled offices. These efforts are in response to shifting workforce expectations and a desire to blend remote work benefits with on-site collaboration advantages. This landscape is fostering optimism amid persistent challenges, offering a chance for investors to capitalize on favorable leasing trends while maintaining agile operational structures.

Resilient Retail and Industrial Growth

In the retail domain, Long Island is witnessing a transformation as entertainment venues fill the void left by vacated spaces. This pivot toward vibrant, leisure-centered environments is revitalizing downtown areas, with a noticeable preference for high-quality Class A properties that match consumer demands for experience-driven destinations. As Steve Gillman from The Shopping Center Group observes, retail destinations are becoming pivotal components of community life, drawing in foot traffic and enhancing local commerce. The industrial sector is proving resilient as well, with ongoing developments and robust interest in future projects indicating the strategic importance of Long Island’s location. Tom DeLuca of Cushman & Wakefield underscores the significance of Long Island for industrial expansion, citing examples such as Trader Joe’s planned distribution center as emblematic of the region’s industrial appeal. With substantial new projects since 2021 and the persistent demand for industrial spaces, Long Island stands as a crucial hub for distribution and manufacturing activities. Such strategic growth positions the sector in a favorable light, demonstrating potential for investors willing to harness Long Island’s geographic advantages.

Strategic Opportunities Ahead

Long Island’s commercial real estate (CRE) market is grappling with a range of challenges and transformations influenced by changing economic dynamics, as discussed at the “2025 State of the Market” event by the Commercial and Industrial Brokers Society of Long Island. Representatives across retail, industrial, office, banking, and construction came together to examine emerging trends and predict upcoming difficulties. One major concern is the rise in construction costs, exacerbated by tariffs that have increased material prices by 20-25%. Devin Kulka from the Kulka Group noted that such tariffs are prompting industry leaders to consider local sources to lessen their impact. Additionally, experts are closely watching the impending maturity of $900 billion in commercial real estate loans over the next two years, as detailed by Patti Kielawa from Hanover Bank, which could intensify pressure on property owners. Despite these hurdles, Long Island’s CRE market shows resilience and adaptability, potentially paving the way for strategic growth in certain sectors.