The roaring engine of the post-pandemic construction boom, once powered by a surge in manufacturing projects, has quieted to a halt, signaling a major market shift that is reshaping the industry’s landscape. Nonresidential construction has long served as a vital economic indicator, its peaks and valleys reflecting national policy shifts, technological advancements, and broad investment priorities. As the sector navigates this new terrain, a clear divergence is emerging between faltering legacy drivers and a powerful new source of growth. This analysis will dissect the recent slowdown, explore the contrasting fortunes of the manufacturing and data center sectors, and provide an expert-backed outlook for the year ahead.

A Tectonic Shift Analyzing the Current Market Dynamics

The Data Behind the Downturn

The statistical evidence paints a clear picture of a market that has lost its upward momentum. An analysis of U.S. Census Bureau data reveals that nonresidential construction spending was flat in October 2025 and, more notably, had fallen by nearly 1% compared to the same period a year prior. This stagnation confirms what many in the industry had begun to feel toward the end of last year: the period of rapid, widespread expansion has concluded, giving way to a more complex and uncertain environment.

At the heart of this downturn is the sharp and sustained decline in manufacturing construction. This segment, which had been a primary driver of growth, experienced a 1% decrease in monthly spending and has plummeted by nearly 10% over the past twelve months. Industry experts attribute this dramatic reversal to the winding down of large-scale “megaprojects” initially spurred by the CHIPS Act, combined with the chilling effect of trade policy headwinds that are now discouraging further investment in domestic factory builds.

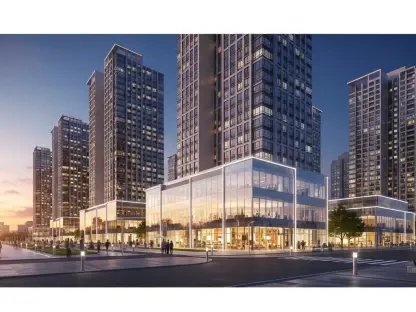

In stark contrast, the data center category has emerged as the principal source of growth and the main force propping up the private nonresidential sector. While nearly every other category shows signs of weakness, the relentless demand for digital infrastructure has created a construction boom of its own. This surge has been so significant that it has effectively masked deeper weaknesses elsewhere in the market, highlighting a powerful gravitational pull that is reshaping investment patterns across the entire industry.

Real World Pivot From Megaprojects to Data Centers

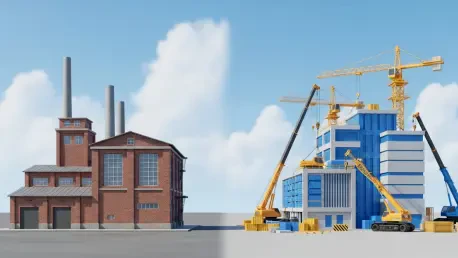

The manufacturing construction boom, once celebrated as the darling of the sector during the Biden era, is now rapidly contracting. The immense capital and labor that flowed into building semiconductor plants and other advanced industrial facilities are now being redirected as those large-scale projects reach completion. This rapid pivot away from manufacturing illustrates the inherent come-and-go nature of building booms, where sector-specific catalysts can create intense but ultimately temporary periods of expansion.

The new engine of growth is unequivocally the construction of data centers. As the demand for cloud computing, artificial intelligence, and digital storage continues its exponential rise, the industry is shifting its resources to meet this new, pressing need. This transition is more than just a change in project type; it represents a fundamental realignment of the nonresidential construction market, where the digital economy’s infrastructure is now the most dominant and promising area of investment.

Voices from the Industry Expert Commentary and Contractor Sentiment

This transition from a manufacturing-led boom to a data center-driven market is widely confirmed by leading industry economists. Anirban Basu, chief economist for the Associated Builders and Contractors (ABC), noted that outside of the “still surging data center category,” there are very few sources of private growth remaining. His analysis underscores the reality that the sector’s stability is now heavily dependent on a single, albeit powerful, driver.

This sentiment is echoed by Ken Simonson, chief economist for the Associated General Contractors of America (AGC), whose organization’s survey data strongly corroborates the spending trends. According to Simonson, contractors report robust demand for data centers and related power projects. However, the outlook for most other categories has become decidedly subdued, reflecting a growing caution that has spread throughout the industry as the year progresses.

Further evidence of this shifting mood comes from the AGC’s 2026 Outlook Survey, which reveals a significant increase in pessimism among contractors compared to the previous year. While optimism was the prevailing mood in 2025, the latest survey indicates that, on balance, more contractors now expect a decline rather than an increase in spending across five distinct project types. This marks a substantial negative shift, indicating that those on the ground are preparing for a more challenging business climate.

The 2026 Outlook Challenges and Opportunities on the Horizon

Looking ahead, the outlook for several specific sectors has turned negative. Contractor expectations for private office, retail, schools, and lodging construction have soured, a notable reversal from the more optimistic forecasts of a year ago. These segments now face headwinds from changing work patterns, e-commerce dominance, and shifting public investment priorities, compounding the challenges for the broader nonresidential market.

The primary challenge facing the industry is the urgent need to find new growth drivers to replace the powerful momentum that has faded with the manufacturing boom. The sector’s current reliance on a single category for growth creates a vulnerability; a slowdown in data center construction, for any reason, could trigger a more pronounced and widespread downturn across the entire nonresidential landscape.

Nevertheless, the data center surge continues to present the most significant opportunity shaping the sector’s immediate future. This boom is not only providing a critical lifeline of projects but is also spurring innovation in construction techniques and supply chain management. The continued evolution of digital infrastructure requirements ensures that, for the near future, this segment will remain a dynamic and influential force in the market.

Conclusion Navigating the New Construction Climate

The nonresidential construction sector has reached a critical inflection point where its overall stability now masks a dramatic internal shift. Key findings show that a steep decline in manufacturing spending is being offset almost entirely by a powerful surge in data center projects, creating a market of diverging fortunes. These trends are more than just industry metrics; they serve as important indicators of broader economic currents and evolving national policy priorities. As such, strategic policy decisions will be crucial in fostering a more balanced and sustainable growth environment. Echoing a call to action from AGC CEO Jeffrey Shoaf, passing a new surface transportation bill and enacting measures to cut regulatory red tape could help stimulate a more widespread recovery, ensuring that growth is not confined to a single hot sector but is shared across the entire construction landscape.