In the dynamic landscape of the residential investment market, Luca Calaraili provides a unique perspective with his extensive experience in construction, design, and technology applications. His insights into current market trends reveal the intricacies of rental growth, value shifts, and strategic adaptations necessary for landlords and tenants alike.

Can you explain the current state of rental growth in the residential investment market?

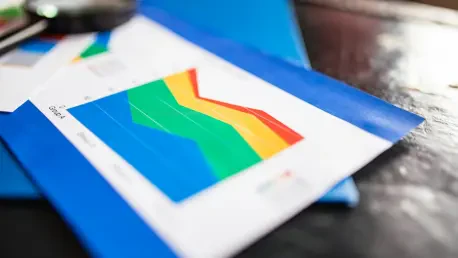

The current rental market is characterized by a stagnation in growth, with the national median rent showing a plateau. Since the end of 2023, we’ve observed very minimal, if any, progress in rental figures. This stagnation reflects a broader trend in the residential investment space where supply is abundant, but demand hasn’t spurred the growth you’d typically expect.

What are the recent trends in national median rent since December 2023?

Since December 2023, the national median rent has largely remained at $600 a week. We’ve witnessed a couple of short-lived spikes, notably in January 2024 and 2025, where rents briefly peaked before returning to the baseline. This consistency indicates a market where potential tenants have negotiation power due to abundant choices.

How have rents in the main centers like Auckland behaved in comparison to national figures?

Rents in major centers like Auckland mirror national trends but exhibit a degree of volatility. Specifically, Auckland’s median rent has been stuck at $650 a week since July of last year, with recent figures slightly declining from their position a year ago. Other main centers show similar behaviors where episodic fluctuations exist but ultimately align with the broader national pattern of stagnation.

What does the increase in tenancy bonds received in April indicate about the rental market supply?

An uptick in tenancy bonds, with a 6.7% increase in April compared to the previous year, signifies an abundant supply of rental properties entering the market. This swell in availability reinforces the notion that prospective tenants have a wide array of options, which suppresses any potential upward pressure on rent prices.

Why do prospective tenants currently have more choices when renting?

The abundance of rental properties gives tenants an edge. This surplus means tenants can be more selective, opting for properties that offer better value without necessarily paying higher rents—a trend that keeps rental prices stable despite the increasing volume of available units.

How does “value creep” affect landlords and tenants differently?

“Value creep” is a fascinating phenomenon where tenants benefit by securing better properties due to falling rents without changing their rental expenditure. For landlords, this process often means potential reductions in their income if they can’t retain tenants at the previous rates, pushing them to reassess their pricing strategies to remain competitive.

Why might asking rents on rental websites differ from the rents reported by Tenancy Services?

Listings on rental websites might reflect landlords adjusting their expectations when facing a market surplus. Meanwhile, the rents reported by Tenancy Services from bonds represent finalized agreements. The disparity often signifies ongoing negotiations and adjustments landlords make in reaction to “value creep.”

What implications do these trends have for landlords in terms of setting asking rents?

Landlords are now facing a scenario where their asking prices need to be competitive, factoring both market supply and tenant expectations. Realistic pricing aligned with the current market conditions could mean the difference between quickly securing a tenant or experiencing prolonged vacancies.

How should individual landlords adapt their strategies to attract new tenants in this environment?

Adaptation is crucial for landlords. They should consider enhancing their property’s appeal through amenities or updates, offering flexible terms, or even revisiting their pricing strategies. Building tenant relationships and understanding their needs can also play a pivotal role in maintaining occupancy and achieving steady rent income.

Do you have any advice for our readers?

Navigating the rental market today requires awareness and agility. Both landlords and tenants need to stay informed about market conditions and trends. For landlords, being responsive to market changes and tenant preferences is key, while tenants should leverage the abundance of choices to find properties that offer exceptional value and quality.