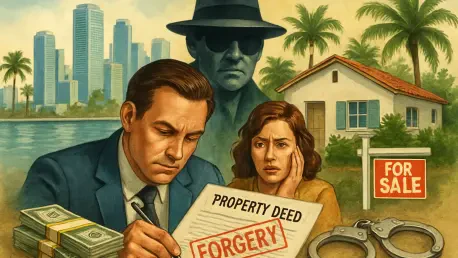

In a shocking turn of events that has rattled the Miami real estate community, a former property manager at a prominent Brickell Bay condominium has been apprehended for allegedly orchestrating a sophisticated fraud scheme. The case, involving over $140,000 in misappropriated funds, exposes the vulnerabilities within condominium associations and raises critical questions about oversight and accountability in property management. This arrest not only highlights individual misconduct but also underscores a systemic issue that has long plagued homeowners’ associations across Florida, prompting renewed calls for stricter regulations and transparency.

Unveiling the Allegations

Details of the Fraudulent Scheme

The accused, Yissely Herrouet, a 37-year-old former property manager at the Club at Brickell Bay building located at 1200 Brickell Bay Drive in Miami, faces multiple felony charges for her alleged role in a “ghost employee” scheme. Employed by FirstService Residential Florida, a leading property management firm, Herrouet reportedly abused her position as a Licensed Community Association Manager (LCAM) to siphon funds from the condominium association. Prosecutors allege that she falsified timesheets and created fictitious employee records to bill the association for work that was never performed. Additionally, she is accused of funneling payments to relatives for redundant services already handled by other vendors, exploiting her authority for personal gain. The scale of the deception, spanning several years, has stunned property owners who entrusted her with their financial oversight, revealing a breach of trust at the highest level.

Beyond the fabricated employee records, Herrouet’s actions allegedly extended to hiring a relative’s company for cleaning and janitorial services, further padding the illicit earnings. The Miami-Dade State Attorney’s Office, under the leadership of Katherine Fernandez Rundle, launched an investigation following a forensic financial audit by her former employer, which uncovered discrepancies totaling over $140,000. This meticulous examination laid bare a pattern of deliberate deceit, painting a picture of calculated fraud that prioritized personal enrichment over fiduciary duty. The charges against her, including organized scheme to defraud and grand theft, reflect the severity of the accusations and the profound impact on the affected community.

Legal Ramifications and Civil Action

Herrouet’s legal troubles are compounded by a civil lawsuit filed by FirstService Residential Florida, which claims she defrauded the company of more than $220,000. The suit seeks restitution for the stolen funds, along with additional costs such as attorney fees, court expenses, interest, and forensic audit fees, amounting to a staggering $738,055.20. This dual pursuit of justice—criminal charges and civil action—underscores the extensive damage attributed to her alleged misconduct. While her current custody status remains unclear as she is not listed in the Miami-Dade County online jail database, the weight of the accusations suggests a prolonged legal battle ahead. The convergence of these proceedings highlights the multifaceted consequences of financial impropriety in trusted roles.

Moreover, the case sheds light on the broader implications for property management firms, which may face reputational harm and increased scrutiny as a result of such scandals. The civil lawsuit not only aims to recover losses but also serves as a deterrent to potential wrongdoers within the industry. Legal experts suggest that the outcome of this case could set a precedent for how similar fraud allegations are handled, potentially influencing policies on background checks and financial oversight for property managers. For the residents of the affected condominium, the pursuit of justice offers a glimmer of hope, though the financial and emotional toll of the betrayal remains a heavy burden to bear.

Broader Implications for Property Management

Systemic Issues in Condominium Associations

The arrest of Herrouet brings to the forefront a persistent problem of financial misconduct within condominium and homeowners’ associations, an issue that Miami-Dade State Attorney Katherine Fernandez Rundle has long championed addressing. Her office has emphasized the critical need for transparency and accountability in these organizations, advocating for legislative reforms to protect property owners from exploitation. Cases like this expose the vulnerabilities inherent in systems where individuals in trusted positions wield significant control over communal funds, often with insufficient checks and balances. The incident serves as a stark reminder of the potential for abuse when oversight mechanisms fail to keep pace with the complexities of modern property management.

Furthermore, the scale of fraud alleged in this instance points to a deeper cultural challenge within some associations, where trust can be misplaced in the absence of rigorous monitoring. Fernandez Rundle’s push for stronger regulations aims to address these gaps, potentially mandating regular audits and stricter licensing requirements for property managers. The hope is to create an environment where financial stewardship is prioritized, safeguarding residents from the devastating effects of fraud. As this case unfolds, it may catalyze much-needed dialogue among policymakers, industry leaders, and property owners about fortifying protections against such deceit.

Future Safeguards and Accountability Measures

Looking ahead, the fallout from Herrouet’s alleged actions could spur significant changes in how condominium associations operate, particularly in terms of financial oversight. Industry stakeholders are already discussing the implementation of more robust internal controls, such as mandatory third-party audits and enhanced training for managers on ethical practices. The goal is to rebuild trust among property owners by ensuring that those in charge of communal funds are held to the highest standards of integrity. Technological solutions, like blockchain-based accounting systems for transparent record-keeping, are also being explored as potential tools to prevent similar schemes in the future.

In reflecting on the events, it’s evident that the legal actions taken against Herrouet mark a pivotal moment in the fight against fraud in property management. The collaboration between law enforcement and private entities in uncovering the deception demonstrates a commitment to justice that resonates with affected communities. Moving forward, the emphasis must remain on proactive measures—strengthening regulations, investing in oversight technologies, and fostering a culture of accountability. Only through such concerted efforts can the industry hope to prevent the recurrence of such betrayals, ensuring that property owners are protected from those who might exploit their trust.