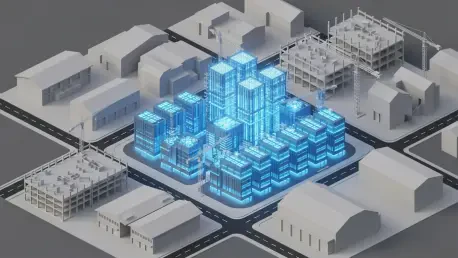

Beneath the surface of headline economic figures, a powerful current is reshaping the nonresidential construction landscape, creating a stark divide that challenges conventional interpretations of market health. This article investigates the apparent contradiction within the nonresidential construction sector, where a broad-based slowdown in project planning at the start of 2026 contrasts sharply with the exceptional and sustained growth in data center development. It addresses the central question of whether the strength in this single, high-value sector is creating a misleading impression of the overall industry’s health.

A Tale of Two Markets: Unpacking a Divergent Construction Landscape

The start of the year has presented a complex picture for the nonresidential building sector, defined by two conflicting narratives. On one side, a general cooling is evident across a wide range of project types, from warehouses and offices to healthcare facilities, suggesting a potential downshift in overall economic activity. Planning activity for these mainstays of the commercial and institutional markets has noticeably softened.

In stark contrast, the digital economy’s insatiable demand for processing power and storage has fueled an unprecedented boom in data center construction. This hyper-growth segment is not just thriving; it is single-handedly propping up top-line industry metrics. The result is a divergent market where one sector’s extraordinary performance may be masking underlying weakness elsewhere, making it critical to look beyond aggregate numbers to understand the true state of the industry.

The Dodge Momentum Index as a Barometer for Future Building

This analysis is contextualized by the Dodge Momentum Index, a key forward-looking indicator that tracks nonresidential projects in the planning phase, leading actual construction spending by approximately one year. Its performance serves as a crucial barometer for future building activity, offering insights into the pipeline of projects that will break ground in the months to come.

The recent performance of the index makes this investigation particularly timely. A 6.3% month-to-month decline in January 2026 reversed gains made in late 2025, signaling a potential cooling of momentum. This dip provides the catalyst for a deeper examination of which sectors are driving this change and which are bucking the trend, highlighting the need to understand the nuances behind the headline figure.

Research Methodology, Findings, and Implications

Methodology

The study’s methodology involves a detailed analysis of the Dodge Momentum Index for January 2026. The data is examined at multiple levels to build a comprehensive picture of market dynamics. This includes a review of the overall index performance to gauge the top-line trend.

Further analysis drills down into the two primary components of the index: commercial and institutional. This separation allows for a clearer understanding of how different segments of the nonresidential market are behaving. Finally, the research conducts a granular review of specific project types and isolates the impact of high-value projects—those valued at over $100 million—that entered the planning pipeline during the month.

Findings

A broad-based slowdown was observed across most major nonresidential sectors. The commercial planning component experienced a significant fall of 7.2%, driven by weakness in key subsectors such as warehouses, offices, and hotels. Similarly, the institutional component declined by a more moderate 4.4%, with reduced planning activity noted for education, healthcare, and public buildings.

In stark contrast to this general cooling, the data center sector demonstrated relentless growth and dominated the high-value end of the market. The three largest projects initiated in January—each valued well over $100 million—were all data centers. These massive undertakings, including the $500 million IEP Data Center in Pennsylvania, highlight the sector’s outsized influence on the planning pipeline.

Despite the monthly drop, the year-over-year outlook remains strong, adding a layer of complexity to the narrative. The overall index is up a substantial 29% compared to January 2025, suggesting a healthy long-term planning pipeline. This annual growth indicates that while momentum may be easing from its recent peak, the foundation for future construction remains significantly more robust than it was a year ago.

Implications

The findings imply that the data center boom is significantly propping up the headline construction figures, potentially masking a wider market slowdown. For stakeholders, this highlights the profound risk of misinterpreting market health based on aggregate data. Such a misreading could lead to misguided investment strategies or ineffective policy decisions that fail to address the specific challenges and opportunities within different sectors.

This trend suggests a market shifting toward a more sustainable, albeit slower, growth pattern for most sectors following a period of heightened activity. The need for sector-specific analysis has never been more critical for making informed business and policy choices. With data centers acting as a major exception, the rest of the industry appears to be entering a phase of normalization, a crucial distinction for anyone navigating the construction landscape.

Reflection and Future Directions

Reflection

This analysis effectively captures the dual narratives currently shaping the nonresidential construction market: a general, modest cooling juxtaposed with an intense, concentrated boom. A key challenge in any monthly analysis is the potential volatility of a single data point. This was mitigated by incorporating year-over-year comparisons, which provide a more balanced and stable long-term perspective on the health of the planning pipeline.

The research successfully identified the primary driver of market strength, but its scope could have been expanded by exploring the specific geographic concentrations of this divergence. Understanding where data center growth is clustered versus where the broader slowdown is most pronounced would offer an additional layer of valuable insight for regional stakeholders and supply chain planners.

Future Directions

Future research should monitor the Dodge Momentum Index over subsequent months to determine if this divergence is a sustained trend or merely a short-term anomaly. Establishing a pattern over a longer period is essential for confirming whether the market is undergoing a fundamental structural shift.

Further studies could investigate the root causes behind this split. For instance, an analysis could contrast the impact of artificial intelligence and cloud computing on data center demand against the effects of interest rates and market saturation on other commercial sectors like warehousing and offices. Moreover, an exploration of the labor and supply chain implications of such a concentrated boom is warranted, as it could strain resources in specific regions and trades.

Conclusion: A Skewed Perspective on a New Market Reality

In summary, the January 2026 data revealed a nonresidential construction market at a critical juncture. While a general slowdown in planning became evident across most commercial and institutional sectors, the unprecedented and powerful boom in data center projects significantly skewed the overall industry outlook. This study confirmed that a granular, sector-by-sector view is essential to accurately understand the current landscape and avoid misinterpretation. The market was not in a simple slowdown but was undergoing a fundamental realignment, driven by the explosive and transformative growth of the digital economy.