Imagine a bustling Perth skyline, where cranes dot the horizon and new commercial developments reshape the city’s central business district, yet many developers struggle to secure the funding needed to bring their visions to life. In this dynamic environment, Pallas Capital, a powerhouse in the non-bank lending sector for commercial real estate (CRE), has stepped into the fray by opening its first office in Western Australia (WA). This strategic move isn’t just about planting a flag in a new region; it’s a response to a growing hunger for alternative financing solutions as traditional banks tighten their grip on lending. With Perth emerging as a hotbed for both residential and commercial growth, Pallas Capital is positioning itself to fill critical gaps in the market, offering tailored financial tools to developers and investors eager to capitalize on untapped potential.

This expansion into WA is part of a broader push by Pallas Capital to extend its footprint across Australia and New Zealand, with recent offices established in Adelaide and plans for a future presence in Canberra. Historically, non-bank lenders have focused on eastern states like New South Wales and Victoria, often leaving regions like Perth on the sidelines. However, the firm sees WA as a land of opportunity, where flexible funding can unlock significant projects. By stepping into this space, Pallas Capital isn’t just following a trend—it’s setting a new standard for how alternative lenders can reshape regional markets with bold, calculated strategies.

Strategic Moves in Western Australia

Targeting an Underserved Market

Pallas Capital’s foray into Western Australia is a deliberate effort to tap into a market that has long been overlooked by non-bank lenders. While the east coast hubs like Sydney and Melbourne have seen fierce competition in CRE financing, Perth and its surrounding areas have often lacked the same level of attention. This gap presents a golden opportunity for a firm like Pallas Capital, which specializes in providing alternative funding solutions. Developers in WA, grappling with stricter bank criteria, are increasingly in need of options for everything from land acquisitions to pre-development loans. By establishing a foothold in Perth, the company is addressing a real pain point, offering financial lifelines that can turn ambitious blueprints into reality. Moreover, this move aligns perfectly with a broader industry shift, where alternative lenders are gaining traction as vital players in property markets hungry for innovation.

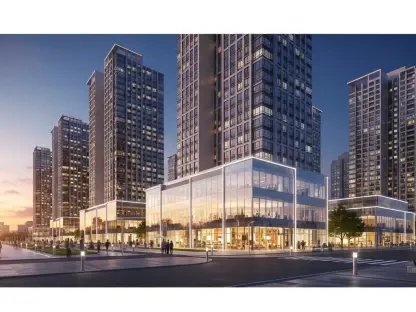

Beyond just filling a gap, Pallas Capital’s presence in WA signals a deeper understanding of regional dynamics. Western Australia boasts unique growth drivers, from mining-related infrastructure to urban expansion in Perth’s central districts. These factors create a fertile ground for investment, yet the absence of diverse funding sources has often slowed progress. Pallas Capital aims to change that narrative by bringing its expertise in crafting bespoke financial packages that cater specifically to local needs. Whether supporting a residential high-rise or repositioning a commercial asset, the firm’s strategy is to become an indispensable partner to WA’s property sector. This targeted approach not only benefits stakeholders in the region but also positions Pallas Capital as a pioneer in redefining how alternative finance can thrive in less saturated markets.

High-Profile Deals as Proof of Capability

One of the most compelling illustrations of Pallas Capital’s impact in WA is the recent $23.7 million refinance of Westend on Murray, a standout office building in Perth’s bustling central business district. This transaction, initiated by the firm’s Queensland team and backed by Pallas Funding Trust No. 5 (PFT5), isn’t just a number on a balance sheet—it’s a testament to the company’s ability to handle complex, high-value deals with precision. The successful execution of this refinance highlights how Pallas Capital can operate seamlessly across regions, leveraging its national network to deliver results. For a market like Perth, where confidence in non-bank lenders may still be building, this deal serves as a powerful signal that the firm has the chops to tackle significant projects and deliver value to investors and developers alike.

Furthermore, the Westend on Murray refinance underscores Pallas Capital’s knack for spotting and seizing strategic opportunities. Perth’s commercial property scene is heating up, with office spaces increasingly in demand as the city cements its status as a key economic hub. By stepping into this space with a marquee transaction, Pallas Capital isn’t just participating in the market—it’s helping to shape its trajectory. This deal also showcases the firm’s financial muscle, backed by substantial capital through vehicles like PFT5, which has drawn heavyweight support from global players such as Morgan Stanley. Such achievements build trust among local stakeholders, proving that Pallas Capital can be a reliable partner in navigating the intricacies of CRE financing, even in a region where it’s still establishing its roots. This early success paves the way for more transformative projects down the line.

Building a Strong Local Team

Key Hires with Deep Expertise

At the heart of Pallas Capital’s push into Western Australia are two seasoned professionals whose expertise is set to steer the firm’s ambitions. Phil Anderton, appointed as Director, Origination WA, brings over two decades of experience in property finance, having honed his skills at the Commonwealth Bank of Australia (CBA). His track record spans a wide array of projects, from sprawling residential developments to major commercial assets like shopping centers and industrial complexes. Complementing him is Michael Glen, named Associate Director, Origination WA, who also hails from CBA with nearly 16 years under his belt in mid-market CRE transactions. Their combined knowledge of diverse asset classes and deep ties to the local property scene make them a formidable duo. Together, they’re tasked with forging critical connections with brokers, developers, and investors to ensure Pallas Capital’s offerings hit the mark in Perth.

What sets Anderton and Glen apart isn’t just their resumes—it’s their intimate understanding of WA’s unique challenges and opportunities. Property finance isn’t a one-size-fits-all game, and regional nuances can make or break a deal. Anderton’s history of working with private, corporate, and institutional clients equips him to tailor solutions that resonate with a broad spectrum of stakeholders. Meanwhile, Glen’s focus on mid-market deals means he’s adept at navigating the specific needs of smaller to medium-sized developers who often face the steepest funding hurdles. Their presence in Perth isn’t merely symbolic; it’s a strategic advantage that allows Pallas Capital to embed itself within the local ecosystem. By leveraging these relationships, the firm can better anticipate market shifts and position itself as a trusted ally in a region ripe for growth.

Leadership Vision for Growth

Guiding the efforts of Anderton and Glen is Group Executive Jason Arnold, whose leadership is shaping Pallas Capital’s broader vision for WA. The goal isn’t just to originate loans but to foster long-term growth in the region’s property market by delivering top-tier service. Under Arnold’s direction, the Perth team is focused on crafting financial solutions that address immediate needs—such as funding for land purchases or pre-development phases—while also laying the groundwork for sustainable success. This means working closely with developers to overcome funding bottlenecks and helping investors expand their portfolios in a competitive landscape. The emphasis on high-level service reflects a commitment to not just entering the market, but becoming a cornerstone of WA’s CRE financing scene with a forward-thinking approach.

This vision extends beyond individual transactions to encompass a broader impact on the region. Pallas Capital recognizes that Western Australia’s property sector is at a pivotal moment, with increasing activity driving demand for innovative financing. Arnold’s strategy involves empowering the local team to unlock prime investment opportunities, whether through asset repositioning or supporting large-scale projects that can redefine Perth’s skyline. By aligning with the evolving needs of brokers and developers, the firm aims to bridge critical gaps left by traditional lenders. This proactive stance, coupled with the expertise of Anderton and Glen, positions Pallas Capital to not only thrive in WA but also to set a benchmark for how non-bank lenders can drive regional progress. It’s a blueprint for growth that promises to yield results for years to come.

Reflecting on Regional Milestones

Looking back, Pallas Capital’s strategic entry into Western Australia through the Perth office marked a turning point for the region’s commercial real estate landscape. The firm’s ability to secure high-profile deals like the Westend on Murray refinance demonstrated its operational strength and built early confidence among local stakeholders. Additionally, the recruitment of seasoned experts such as Phil Anderton and Michael Glen proved pivotal in grounding the company’s efforts in local know-how. Against the backdrop of a thriving CRE debt market, these moves solidified Pallas Capital’s role as a key player in addressing alternative financing needs. For the future, the focus should remain on deepening ties with WA’s property community, exploring untapped niches within the market, and continuing to innovate with financial products that empower developers and investors. Scaling this model to other emerging regions could further amplify the firm’s impact, ensuring that the momentum gained in Perth becomes a catalyst for nationwide transformation in non-bank lending.