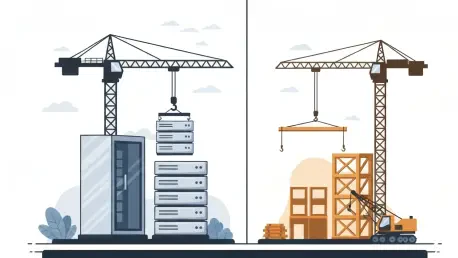

Recent analysis of the U.S. construction industry has unveiled a subtle yet significant contraction in the national project pipeline, with the average backlog of work falling to its lowest point since the early months of 2024. While this headline figure suggests a broad-based cooling in the sector, a closer examination of the data reveals a far more complex and fractured landscape. Beneath the surface of a modest overall decline, a stark divergence is underway, cleaving the industry into two distinct tiers. The fortunes of construction firms are increasingly determined not by regional demand or specialization, but by a simple metric: scale. This growing divide is reshaping the competitive environment, creating a market where corporate giants thrive on massive, specialized projects while smaller businesses navigate an increasingly precarious terrain marked by shrinking opportunities and heightened economic pressures. This bifurcation signals a fundamental shift in the industry’s structure, with long-term implications for competition, innovation, and stability.

A Market Divided by Scale

The Widening Chasm Between Firms

The overall reduction in the national construction backlog to 8.1 months masks a critical underlying trend where the burden of the slowdown is not being shared equally across the industry. This decline was almost exclusively driven by a sharp contraction in the project pipelines of smaller companies. Specifically, contractors with annual revenues under $30 million experienced a significant erosion of their future work, with backlogs plummeting to levels not seen in over four years. This precipitous drop suggests these firms are facing mounting challenges in securing new contracts, leaving them highly vulnerable to market fluctuations and economic headwinds. For local economies that depend on these smaller enterprises for employment and development, this trend signals a potential for increased instability. The shrinking pipeline for this segment of the market points to a consolidation of opportunities at the top, making it increasingly difficult for smaller players to compete and sustain their operations in an environment that heavily favors larger, more capitalized entities.

In stark contrast to the difficulties faced by their smaller counterparts, the largest contractors in the industry have demonstrated remarkable resilience and growth. Firms with annual revenues exceeding $100 million were the only group to report an expansion in their project backlogs, posting gains not only on a month-over-month basis but also year-over-year. This robust performance indicates that these corporate giants are not only weathering the broader market slowdown but are actively capitalizing on current conditions to strengthen their market position. Their expanding pipelines are a testament to their ability to secure large-scale, long-term projects that provide a stable and predictable revenue stream, effectively insulating them from the volatility affecting the rest of the market. This dynamic solidifies the emergence of a two-tiered system, where a select group of large firms captures a disproportionate share of the available work, while a vast number of smaller businesses are left to contend for a diminishing pool of projects, intensifying competition and squeezing margins.

The Megaproject Insulation Effect

The primary driver behind the widening gap between large and small construction firms is the concentration of work in high-value megaprojects, particularly within the booming data center sector. These massive, technologically complex facilities require immense capital, specialized expertise, and extensive logistical capabilities that are typically beyond the reach of smaller companies. As a result, this lucrative market segment has become the exclusive domain of the industry’s largest players. Recent data starkly illustrates this reality: an estimated 37% of contractors with over $100 million in annual sales hold contracts for data center construction. This figure stands in sharp contrast to the less than 6% of the smallest firms involved in such projects. This disparity has created a powerful insulation effect, shielding large corporations from the softening demand seen in other areas of the construction market. While smaller firms grapple with uncertainty, their larger competitors are buoyed by a steady stream of multibillion-dollar investments fueled by the relentless growth of the digital economy.

The concentration of megaproject work has profound consequences for the competitive balance of the entire construction industry. By being effectively locked out of the most dynamic and profitable market segment, smaller contractors are forced to compete in more conventional and often saturated sectors, such as commercial and residential construction. These areas are more susceptible to economic cycles and are currently experiencing softer demand, leading to intensified competition for a shrinking number of available projects. This environment puts immense downward pressure on bids and profit margins for smaller firms, making it increasingly challenging for them to remain profitable and invest in growth. The imbalance not only exacerbates the financial vulnerability of smaller companies but also risks stifling innovation and diversity within the industry, as a larger portion of capital and opportunity becomes concentrated in the hands of a few dominant players who are focused on a narrow but highly profitable niche.

Navigating an Uncertain Outlook

A Fragile Sense of Optimism

Despite the challenging backlog data for a significant portion of the industry, contractor confidence has remained surprisingly resilient, painting a mixed but generally optimistic picture for the coming six months. Key indicators tracking expectations for sales, profit margins, and staffing levels all remained above the 50-point threshold, a score that traditionally signals an anticipation of future growth rather than contraction. In a particularly encouraging sign, sales expectations actually improved in the latest survey period, suggesting that many firms, regardless of their current backlog, still perceive a healthy pipeline of potential opportunities on the horizon. This undercurrent of optimism indicates that business leaders believe they can navigate the current headwinds, perhaps by tapping into niche markets, improving operational efficiency, or banking on a broader economic stabilization. However, this confidence appears to be built on a fragile foundation, as deeper anxieties regarding profitability and workforce stability are beginning to surface with greater intensity across the sector.

While the outlook for sales provides a glimmer of hope, a closer look at other confidence metrics reveals growing apprehension among construction leaders. Expectations for future staffing levels have begun to weaken, hinting at a potential slowdown in hiring as firms adjust to a more uncertain project pipeline. The most significant area of concern, however, lies in the outlook for profit margins. The proportion of contractors who anticipate an expansion in their margins over the next two quarters has fallen to just 33.6%, marking the lowest level of confidence in profitability recorded in over a year. This sharp decline reflects a growing realization that securing new work may come at the cost of profitability. The pressure to submit competitive bids in a tightening market, combined with other escalating business costs, is forcing many contractors to reassess their financial forecasts. This erosion of confidence in future profits is a critical warning sign that the industry’s overall health may be more precarious than the optimistic sales outlook suggests.

The Resurgence of Cost Pressures

A primary catalyst for the growing pessimism surrounding profit margins is the re-emergence of rising material costs as a significant industry concern. After a period of relative stability that offered contractors some much-needed predictability in bidding and project management, prices for key construction materials have begun to climb once again. This renewed inflationary pressure directly threatens the financial viability of both current and future projects, as unexpected cost increases can rapidly erode or even eliminate planned profits. For contractors who have already locked in prices on long-term projects, this resurgence in costs creates a significant financial risk. The volatility makes it increasingly difficult to develop accurate cost estimates for new bids, forcing firms to either absorb the potential for higher costs, which squeezes margins, or increase their bid prices, which risks making them uncompetitive in a market where every project is fiercely contested.

The impact of resurgent material costs is not distributed evenly across the industry; instead, it reinforces the two-tiered market dynamic. Large-scale contractors are substantially better equipped to manage this challenge. Their immense purchasing power allows them to negotiate more favorable, long-term pricing agreements with suppliers, and their sophisticated supply chain management systems enable them to hedge against price volatility. They can often buy materials in bulk, securing discounts and locking in costs far in advance. In contrast, smaller firms lack this leverage. They typically purchase materials on a project-by-project basis and are therefore far more exposed to short-term price fluctuations in the open market. This disadvantage means that rising material costs will likely hit smaller contractors harder, further compressing their already tight profit margins and widening the competitive gap between them and their larger counterparts. This dynamic ensures that cost pressures become another factor that disproportionately favors the industry’s giants.

Rethinking Strategy in a Polarized Industry

The developments of the past year underscored a pivotal shift in the construction landscape, compelling firms of all sizes to fundamentally re-evaluate their strategies. The shrinking overall backlog, coupled with the stark division between megaproject-fueled growth for large corporations and stagnation for smaller businesses, made it clear that traditional approaches were no longer sufficient. This period marked a critical inflection point where adaptability and strategic foresight became the primary determinants of success. For smaller firms, survival necessitated a move away from direct competition with larger rivals and toward the cultivation of niche markets, the formation of strategic joint ventures to bid on larger projects, and the aggressive adoption of new technologies to boost efficiency and reduce overhead. For the industry’s giants, the challenge shifted toward managing the inherent risks of over-concentration in a few key sectors and ensuring their massive project pipelines remained resilient to potential disruptions in technology or global supply chains. The market’s polarization demanded a new playbook, one that prioritized agility and specialization over sheer scale alone.