A high-profile legal battle centered on the Great Northern Block condominium project in downtown Fargo has culminated in a jury finding the developer guilty of fraud and breach of contract, a verdict that now faces a direct challenge from the very company held accountable. The developer, T&K Property Management, has been ordered to pay nearly $900,000 in damages to three buyers who allege a pattern of broken promises and financial misconduct. Now, in a bold post-verdict maneuver, the company is asking a Cass County court to significantly reduce that amount, raising a critical question about the finality of a jury’s decision and the lengths a developer will go to mitigate the financial consequences of its actions. This case serves as a stark examination of developer accountability, the sanctity of contractual obligations, and the severe personal and financial turmoil that can ensue when a dream home purchase turns into a protracted legal nightmare.

A Project Plagued by Broken Promises

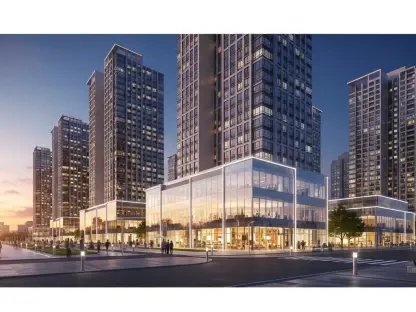

The legal storm began to gather in November 2023, when three separate buyers initiated a civil lawsuit against T&K Property Management and its managing agent, Tom Smith. These buyers had collectively invested approximately $1 million into what was marketed as a key component of the downtown Mercantile complex, which had opened its doors in April 2022. However, the nine-unit Great Northern Block project became a source of immense frustration as the developer repeatedly failed to complete the condominiums by the promised dates. The lawsuit laid out a damning set of allegations, accusing T&K and Smith of not only breach of contract but also outright fraud. The claims extended to misrepresenting common area amenities, using substandard materials to cut corners, failing to pay subcontractors, and falsely asserting that attached garages were included in the purchase price, painting a picture of a project mired in deception and unfulfilled commitments from the outset.

The deeply personal and financially damaging experiences of each plaintiff formed the emotional core of the case against the developer. For Rob Lauf of KLD Enterprises, the need for a timely move was critical; having suffered a stroke, he required an accessible home and had structured the sale of his previous residence to avoid significant capital gains taxes, a plan contingent on a swift closing. His purchase agreement even included the clause “time is of the essence.” Yet, the promised closing date was repeatedly pushed back for over a year, forcing him into a rental apartment and directly causing him to incur tens of thousands in tax liabilities. Similarly, Mark and Stephanie Erceg, a family from Georgia, paid an additional $200,000 for custom work on a unit intended for their daughters, only to be told months later that T&K would sell the unit to another buyer and keep their money. Meanwhile, Fargo couple Jolie and Patrick Graybill invested nearly $30,000 in design selections for their unit, only to have T&K unilaterally increase the final purchase price by $70,000 without justification, effectively nullifying their agreement when they refused to pay.

The Weight of the Verdict

The legal proceedings leading to the trial were anything but straightforward, marked by significant procedural hurdles and contentious disputes that underscored the difficult nature of the case. The journey to the courtroom included a judge recusing themselves from the case, multiple continuances that delayed resolution, and at least one successful motion by the plaintiffs’ attorneys to hold T&K Property Management in contempt of court for its persistent refusal to comply with discovery requests for essential records and receipts. In a bold counter-offensive, the developer filed its own claims against the buyers, alleging abuse of process and slander of title in an attempt to shift the narrative and deflect from its own failures. However, these counterclaims ultimately faltered; the slander of title claim was dismissed by the presiding judge during the trial, and the jury later found no merit in the allegation of abuse of process, clearing the way for a verdict focused solely on the developer’s conduct.

After a tense, weeklong trial in Cass County, the jury returned a “special verdict” on September 16, delivering a decisive victory for the plaintiffs. The jurors found that T&K had committed both fraud and breach of contract, holding the developer fully accountable for the financial and emotional hardship inflicted upon the buyers. The verdict came with a substantial financial penalty, meticulously broken down to compensate each party for their specific losses. KLD Enterprises and Rob Lauf were awarded over $450,000 plus interest to cover their extensive damages, including the significant tax liability. The Ercegs were awarded nearly $250,000 plus interest for their lost investment, while the Graybills were granted the return of the nearly $30,000 they had paid, plus interest. On October 20, Judge Stephen McCullough entered the final judgment, cementing the total amount owed by T&K Property Management at a formidable $893,784.29, a figure that validated the buyers’ long and arduous fight for justice.

A Last Ditch Effort to Overturn Justice

More than two months after the jury’s unequivocal decision, T&K Property Management launched a final attempt to lessen the blow, filing a motion on November 18 to reduce the damage award by $279,830.21. In the filing, the developer characterized the amount determined by the jury as both “unreasonable” and “unjust.” In a supporting declaration, Tom Smith presented arguments aimed at shifting responsibility back onto the buyers. He contended that the Ercegs’ $200,000 payment was tied to an “addendum” for “outrageous selections in the design specifications” and argued that because the final purchase agreement was never signed, the addendum’s enforceability was “limited.” Regarding Rob Lauf’s substantial tax losses, the motion argued that he should have taken “remedial steps to invest… capital gains in other property to avoid taxation,” suggesting that the burden of mitigating the financial damage caused by T&K’s delays rested not with the developer, but with the victim of its breach.

The plaintiffs’ legal team from the Fredrickson & Byron law firm issued a sharp and swift rebuttal on December 1, asserting that there was “no basis” whatsoever for any reduction in the damages awarded by the jury. They argued that T&K was improperly attempting to introduce new evidence and re-litigate arguments long after the trial had concluded, a move they suggested was a desperate effort to escape the court’s judgment. The attorneys maintained that the “damage claims were limited, anticipated, and reasonable,” fully supported by the evidence presented and validated by the jury’s careful deliberation. As all parties await Judge McCullough’s ruling on this critical motion, the ongoing turmoil surrounding the Great Northern Block is starkly evident on its website, where the three disputed condominium units—the very properties at the heart of this legal saga—are currently listed as available for sale, a silent testament to a project where promises were broken and justice remains a work in progress.