Imagine a world where roads are laid down with such precision and speed that traffic disruptions become a rarity, and infrastructure projects are completed ahead of schedule. This vision is becoming reality thanks to the booming asphalt pavers market, a vital cog in the global construction equipment industry. These machines, designed to lay asphalt for highways, streets, and parking lots, are at the heart of modern infrastructure development. As urbanization races forward and the demand for seamless connectivity skyrockets, the market for asphalt pavers is projected to grow from USD 2.17 billion in 2024 to an impressive USD 3.32 billion by 2034, driven by a steady compound annual growth rate (CAGR) of 4.4% over the forecast period from 2025 to 2034. What’s fueling this remarkable expansion? It’s a blend of massive government investments, cutting-edge technology, and regional growth trends that are reshaping how roads are built. Let’s explore the key forces behind this surge and why they matter to industry players and beyond.

Unpacking the Market’s Growth Trajectory

The asphalt pavers market is on a steep upward climb, reflecting the world’s unyielding push for better infrastructure. With a valuation of USD 2.17 billion in 2024, industry projections point to a robust increase to USD 3.32 billion by 2034. This isn’t just about numbers; it’s a testament to the pressing need for reliable transportation networks as cities expand and populations swell. Infrastructure isn’t merely a backdrop—it’s the foundation of economic growth, and asphalt pavers play a pivotal role in ensuring that foundation is solid. From sprawling interstate highways to urban arterials, these machines are indispensable. Moreover, the market’s segmentation reveals intriguing patterns, with wheeled pavers gaining ground for their agility and efficiency. This growth narrative isn’t just about volume; it’s about how the industry is adapting to meet modern demands with smarter, more versatile equipment. As global connectivity becomes non-negotiable, the market’s trajectory signals a deeper shift toward innovation and scale.

Delving deeper into this growth story, the dominance of certain equipment types stands out as a key indicator of market evolution. Variable-width pavers, for instance, captured over 97% of the market share in 2024, showcasing their versatility across diverse paving projects. This overwhelming preference highlights how contractors prioritize flexibility to tackle everything from narrow city streets to wide rural roads. Meanwhile, the steady CAGR of 4.4% projected through 2034 underscores a consistent demand fueled by both new construction and the rehabilitation of aging infrastructure. It’s worth noting that this growth isn’t uniform—different regions and project types contribute uniquely to the overall picture. Yet, the overarching theme remains clear: the asphalt pavers market is expanding in response to a world that can’t afford to stand still. As governments and private players ramp up investments, the ripple effects are felt across supply chains and job markets, amplifying the market’s broader impact.

Forces Propelling Market Expansion

At the core of the asphalt pavers market’s surge lies a global infrastructure boom that shows no signs of slowing down. Governments worldwide are funneling massive budgets into road construction, highway expansions, and urban development projects to drive economic progress and improve connectivity. This is especially evident in emerging economies where rapid urbanization creates an urgent need for extensive transportation networks. Think of sprawling cities in Asia or Africa where new roads are lifelines for growing populations. Such investments aren’t just about laying asphalt; they’re about building pathways to opportunity. The ripple effect is clear—more projects mean higher demand for efficient paving equipment, pushing manufacturers to scale up production and innovate. This dynamic positions infrastructure development as the primary engine of market growth, with asphalt pavers becoming indispensable tools in shaping the future of transportation.

Beyond the sheer scale of infrastructure projects, technological innovation is rewriting the rules of the game for asphalt pavers. Modern machines are no longer just heavy equipment; they’re smart systems equipped with automated controls, GPS-guided precision, and fuel-efficient engines. These advancements aren’t mere upgrades—they transform how projects are executed, slashing material waste, cutting costs, and speeding up timelines. Imagine a paver that can adjust its width mid-project or monitor performance in real time to prevent breakdowns. Such capabilities align with global sustainability goals, reducing environmental footprints while meeting strict project deadlines. Contractors now look to these high-tech solutions to stay competitive, driving adoption rates and, in turn, market expansion. As technology continues to evolve, it’s not hard to see why it’s a cornerstone of growth, ensuring that efficiency and eco-consciousness go hand in hand in the paving industry.

Regional Trends Shaping the Future

When it comes to regional influence, the Asia-Pacific region stands as the heavyweight champion of the asphalt pavers market. In 2024, it held the largest share, propelled by ambitious infrastructure initiatives in powerhouses like China and India. These countries are building highways, airports, and urban grids at a staggering pace, fueled by government policies that prioritize connectivity as a driver of economic growth. This dominance isn’t likely to wane anytime soon, as ongoing urbanization and population surges keep demand sky-high. It’s a region where the sheer volume of projects—from megacities to rural corridors—creates a constant need for advanced paving solutions. The Asia-Pacific’s leadership in this market isn’t just about scale; it’s about setting the tone for how infrastructure can transform societies, making it a critical area to watch as growth unfolds through 2034.

However, the story doesn’t end with Asia-Pacific. North America and Europe are carving out their own significant roles with a focus on modernization and sustainability. These mature markets are less about building from scratch and more about upgrading aging road networks to meet contemporary standards. In the United States and Canada, federal initiatives are funneling funds into infrastructure renewal, while European nations like Germany and France push for smart, eco-friendly paving technologies. Meanwhile, regions like South America and the Middle East & Africa are emerging as hotbeds of opportunity, with increasing investments in transportation despite challenges like political instability and funding gaps. For manufacturers, these disparities highlight the need for tailored strategies—high-tech solutions for developed markets and cost-effective options for emerging ones. This regional mosaic paints a complex but promising picture of global growth potential.

Navigating Challenges and Competition

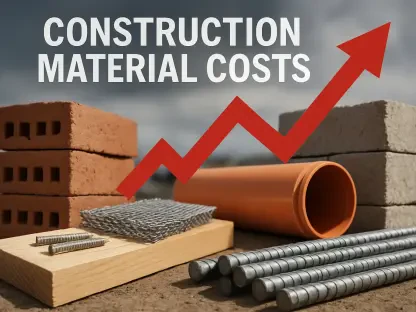

Even with a bright outlook, the asphalt pavers market isn’t without its hurdles. Regulatory complexities and steep entry barriers often stifle new players, limiting fresh ideas and competition in certain areas. Add to that the high upfront costs of cutting-edge equipment, which can be a dealbreaker for smaller contractors operating on tight budgets, especially in price-sensitive regions. Then there are supply chain disruptions and volatile raw material prices, which throw a wrench into manufacturing timelines and inflate costs. These challenges aren’t just speed bumps; they threaten to slow the market’s momentum if left unaddressed. For the industry to sustain its growth, stakeholders must find ways to streamline regulations, offer flexible financing, and stabilize supply chains. Overcoming these obstacles isn’t optional—it’s essential to keep the market rolling forward.

On the flip side, the competitive landscape adds another layer of intensity to the market’s evolution. Industry titans like Caterpillar Inc., AB Volvo, and WIRTGEN GROUP are in a relentless race to out-innovate each other, pouring resources into research and development to roll out next-generation pavers. Their focus isn’t just on tech—it’s on delivering cost-effective, reliable solutions that meet a wide range of customer needs. Strategic partnerships, mergers, and acquisitions are common plays to expand global footprints and tap into new markets. This fierce rivalry drives progress, ensuring that advancements trickle down to end users in the form of better equipment and services. Yet, it also means smaller players must hustle to carve out niches, often through specialized offerings or regional focus. Competition, while challenging, is ultimately a catalyst, pushing the entire market to raise the bar for what asphalt paving can achieve.

Paving the Path Ahead

Looking back, the asphalt pavers market has shown remarkable resilience and adaptability in reaching a valuation of USD 2.17 billion by 2024. The journey thus far, marked by technological leaps and massive infrastructure undertakings, laid a strong foundation for the projected rise to USD 3.32 billion by 2034. Governments played their part with substantial investments, while industry leaders pushed boundaries with innovations that redefined efficiency. Challenges like regulatory barriers and cost constraints tested the market’s mettle, yet the response—be it through smarter equipment or strategic collaborations—demonstrated a sector ready to evolve. Reflecting on this period, the growth wasn’t just about numbers; it was about meeting the world’s urgent need for better roads and connectivity.

Moving forward, the focus must shift to actionable strategies that sustain this momentum. Manufacturers should prioritize developing affordable, eco-friendly pavers to capture emerging markets while meeting sustainability mandates in developed regions. Policymakers could ease growth by simplifying regulations and boosting funding for infrastructure, especially in high-potential areas like South America and the Middle East & Africa. Meanwhile, contractors might explore equipment leasing models to access advanced tech without hefty upfront costs. As the market eyes 2034, collaboration across stakeholders will be key to tackling supply chain woes and ensuring that innovation doesn’t outpace accessibility. This isn’t just about paving roads—it’s about paving a future where infrastructure supports global progress without compromise.