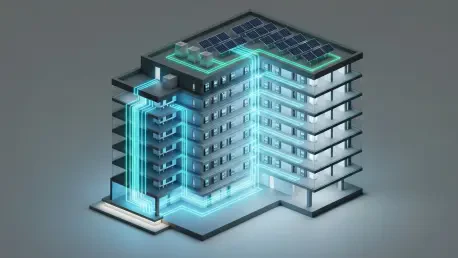

Commercial property owners are frequently confronted with the substantial financial burden of modernizing their buildings to meet today’s rigorous energy efficiency and sustainability standards, a challenge that can sideline even the most forward-thinking renovation plans. The high upfront costs of these critical upgrades often create a significant barrier, postponing vital projects that could lower operational expenses, enhance property value, and contribute to broader community climate goals. To address this persistent challenge, the Green Building Alliance recently organized a pivotal virtual roundtable dedicated to demystifying an innovative financial mechanism: Commercial Property Assessed Clean Energy (C-PACE). This event brought together building owners, small businesses, and property developers to explore C-PACE as a powerful tool for financing 100% of clean energy and efficiency projects without any initial capital investment. The program is structured as a low-cost, long-term loan that is uniquely repaid through a special assessment added to the property’s tax bill. This structure conveniently ties the financing to the building rather than the owner, simplifying the path to modernization and presenting a viable solution for everything from comprehensive gut rehabilitations to large-scale renewable energy conversions.

A Deep Dive Into C-PACE Mechanics and Success Stories

To provide a multifaceted view of the C-PACE ecosystem, the roundtable assembled a distinguished panel of experts, each representing a crucial link in the financing chain. Elaine Evosevic-Lozada of the Sustainable Energy Fund’s C-PACE Program offered an administrator’s perspective, clarifying the policy framework and eligibility requirements that guide these investments. Providing a tangible example of the program’s success, developer Garett Vassel presented a compelling case study on “The Commodore,” a mixed-use redevelopment project that leveraged C-PACE funding to achieve its ambitious sustainability targets. His firsthand account illustrated how the financing mechanism can transform a complex renovation into a financially feasible endeavor. Rounding out the panel, Shelah Wallace, a senior vice president from the capital provider Bayview Asset Management, shed light on the investor’s viewpoint. She explained why C-PACE is considered a secure, attractive asset and detailed the process of underwriting these unique projects. The discussion covered a wide array of eligible upgrades, including whole-building insulation, advanced geothermal systems, combined heat and power installations, smart building control systems, and high-efficiency HVAC equipment, demonstrating the program’s flexibility in meeting diverse property needs.

The comprehensive dialogue at the roundtable successfully repositioned C-PACE from a niche financial product into a mainstream strategic tool for sustainable urban development. By bringing together a program administrator, a developer, and a capital provider, the event provided attendees with a holistic understanding of the C-PACE process, from initial application to project completion and long-term repayment. The case study of “The Commodore” served not merely as an example but as a powerful testament to the program’s real-world impact, demonstrating that ambitious green building goals are well within reach for commercial property owners who previously felt constrained by capital limitations. Ultimately, the session illuminated a clear and accessible pathway for leveraging private capital to fund public-interest projects. This underscored a pivotal shift toward financing models that generate both robust economic returns for investors and significant environmental benefits for the community, equipping participants with the practical knowledge needed to confidently pursue their own modernization initiatives.