A stark division is cleaving the American construction landscape, where a technological gold rush coexists with widespread operational distress that threatens the industry’s foundational stability. The U.S. construction industry is entering 2026 as a tale of two markets. While explosive growth in niche sectors like data centers paints a picture of prosperity, a majority of the industry is grappling with an intensifying labor crisis, disruptive immigration enforcement, and persistent tariffs. This article analyzes the fragmented landscape revealed in the Associated General Contractors of America’s 2026 Outlook, exploring the distinct pockets of growth, the overarching challenges, and the implications for the industry’s future.

A Dual-Track Market: High-Tech Booms and Widespread Stagnation

The Bright Spots: Data Centers and Power Projects Fueling Optimism

The most significant area of optimism is the data center market, which continues its extraordinary expansion. An overwhelmingly positive outlook is reflected in the 65% of contractors anticipating growth in this sector, while a mere 8% expect a decline. This robust and concentrated demand is a primary growth engine, creating a highly lucrative niche for firms with the specialized skills to compete. For these contractors, the current business environment is exceptionally strong.

This technology-driven boom has a powerful ripple effect, most notably in the power sector. This is the only other construction category to register a higher positive reading compared to the previous year, a trend directly fueled by the immense energy requirements of new data centers. The symbiotic relationship between these two markets creates a concentrated pocket of prosperity, insulating specialized contractors from the broader economic headwinds affecting the rest of the industry.

Fading Optimism in Traditional Sectors

In stark contrast, optimism has faded considerably outside of the tech-related bubble. Even with significant federal funding initiatives, the forecast for public works, including transportation and infrastructure projects, has declined. This suggests that macro-level challenges are beginning to outweigh the stimulus, creating new obstacles for contractors who rely on government contracts and hampering progress on national infrastructure goals.

The cooling trend extends into the private sector, where expectations for previously strong markets have soured. The outlook for warehouse and multifamily residential projects has notably weakened, signaling a broader downturn in these crucial areas. This decline underscores the industry’s fragmented health, where the success of one segment does not translate to stability for all, leaving many contractors facing an increasingly uncertain future.

Overarching Challenges Confronting the Industry

An Intensifying Labor and Skills Crisis

The most critical challenge confronting nearly all contractors is a severe and deepening labor shortage. An alarming 82% of firms report difficulty filling hourly craft positions, and an almost equally high 80% struggle to hire salaried personnel. According to AGC’s chief economist, Ken Simonson, this represents the highest level of hiring difficulty in three years. The consequences are tangible, with 60% of firms reporting that projects were postponed or canceled due to a lack of available workers.

This workforce gap is compounded by a demographic crisis. As Kyle Van Slyke, COO of Musselman & Hall Contractors, highlights, the industry is experiencing a “brain drain” as retiring senior leadership is not being replenished. This ongoing loss of seasoned professionals creates a vacuum of institutional knowledge, making it more difficult to train the next generation and effectively manage the complex projects that drive the economy.

The Disruptive Impact of Immigration Enforcement

A significant disruptive factor adding to the labor strain is increased immigration enforcement, which has affected one-third of construction firms in the past six months. This impact often manifests unpredictably, with workers failing to appear for shifts or entire subcontractor crews disappearing overnight. Such instability creates significant project delays and logistical chaos for general contractors trying to maintain schedules.

The issue goes beyond workforce absenteeism. A notable 6% of firms reported that Immigration and Customs Enforcement officers physically appeared at a job site, creating an atmosphere of uncertainty that reverberates through the local labor pool. This regulatory pressure directly constricts an already strained workforce, exacerbating the industry’s inability to meet project demands.

The Persistent Burden of Material Tariffs

Tariffs on essential construction materials continue to exert significant financial pressure on the industry, with 70% of contractors reporting adverse effects in 2025. This has forced firms to adopt various strategies to mitigate the impact on their bottom line. In response, 40% increased their bid prices, 33% accelerated material purchases to lock in costs, and 35% managed to pass the added expenses on to project owners.

However, not all firms can transfer these costs. A significant 11% of contractors had to absorb most or all of the financial burden from tariffs themselves. This direct erosion of profit margins makes it more difficult for these companies to invest in training, technology, and competitive wages, further widening the gap between thriving firms and those struggling to remain profitable.

Future Outlook: Navigating Deepening Divisions

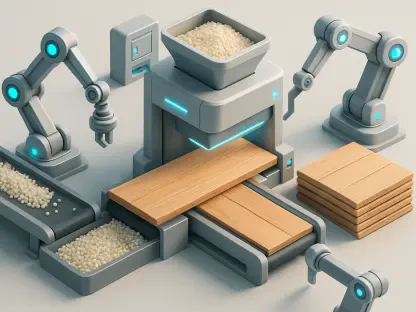

The trend toward fragmentation is poised to accelerate. Specialization in high-demand sectors like data centers will likely yield significant rewards, while contractors in more traditional markets may face continued margin pressure and project instability. The industry-wide challenges of labor shortages and regulatory uncertainty will likely widen the gap between thriving and struggling firms, potentially slowing national infrastructure goals and impacting housing availability if not addressed. This crisis may also force faster adoption of labor-saving technologies, such as robotics and prefabrication, fundamentally reshaping how the industry operates.

Conclusion: A Call for Stability in a Fractured Landscape

In summary, the 2026 construction outlook is a study in contrasts. As AGC CEO Jeffrey Shoaf stated, the year “offers a handful of clear bright spots amid a growing number of challenges.” While a segment of the market thrives on the tech boom, the industry as a whole is being held back by a severe labor crisis, disruptive immigration policies, and costly tariffs. To foster sustainable growth across the entire sector, the AGC is urging the presidential administration and Congress to implement policies that address construction workforce shortages and create a more stable and predictable business environment for all.