A comprehensive analysis of Australia’s burgeoning “living sector” reveals a significant structural evolution within the nation’s housing market, with the build-to-rent (BTR) model emerging as a formidable force. This movement is fundamentally centered on the professionalization of the rental experience, aiming to create a more stable, high-quality, and predictable market for both tenants and investors. This paradigm shift marks a clear departure from the traditional rental landscape, which has been overwhelmingly dominated by a fragmented network of small-scale, individual landlords. As institutional capital flows into this space, the very definition of renting in Australia is being reshaped, promising a new era of consistency, quality, and long-term stability that could set a new benchmark for the entire industry and address some of the most persistent challenges faced by renters.

The BTR Revolution: A Paradigm Shift

Elevating the Experience for Tenants and Investors

The core innovation of the build-to-rent model lies in its ability to replace the often unpredictable and fragmented system of individual landlords with a consolidated, professional management structure. For tenants, this transition translates directly into a markedly improved living experience. It introduces a level of stability and service consistency that is frequently absent in the private rental market. Key benefits include the availability of longer-term leases, which provide enhanced security of tenure and allow residents to establish genuine roots in their communities without the looming uncertainty of a lease not being renewed. Furthermore, this model is designed to address common pain points such as inconsistent property maintenance and unresponsive landlords. With on-site management and a corporate commitment to brand reputation, service requests are handled systematically, ensuring a higher standard of upkeep and resident satisfaction, fundamentally altering the landlord-tenant dynamic from a transactional relationship to a service-oriented one.

For investors, the BTR sector presents a compelling and timely new asset class that addresses a significant gap in the Australian market: the scarcity of large-scale, income-generating residential investment opportunities. Historically, institutional capital has found it challenging to gain exposure to the residential sector due to its fragmented ownership. The BTR model provides a direct solution by creating large, consolidated portfolios that are professionally managed and can be scaled effectively. This offers a source of steady, reliable yields, backed by strong underlying demand fundamentals in a country with a structural housing shortage. For institutional investors, such as pension funds and sovereign wealth funds seeking stable, long-term returns to match their liabilities, professionally managed residential real estate offers an attractive proposition. The model’s predictable income streams and potential for capital appreciation, combined with the non-discretionary nature of housing, make it a resilient addition to diversified investment portfolios.

Setting a New Standard for Quality and Design

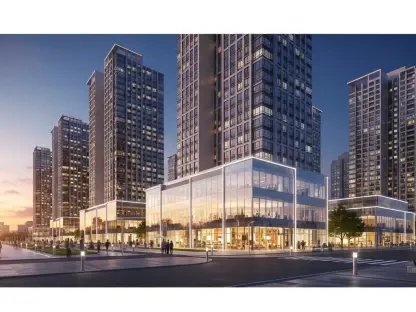

A significant consequence of the institutional investment flowing into the build-to-rent sector is the establishment of a new and elevated benchmark for quality and design in Australian rental housing. BTR projects are typically characterized by their high standards, often featuring newly constructed apartment buildings with superior energy efficiency, modern fixtures, and thoughtful layouts. These developments are strategically situated in well-located urban areas with excellent access to public transportation, employment hubs, and lifestyle amenities, making them highly desirable for a wide range of tenants. Unlike many older rental properties managed by individual landlords, BTR buildings are designed and built specifically for the rental market, incorporating durable materials and efficient systems that reduce long-term maintenance costs while enhancing the resident experience. This focus on quality from the ground up ensures a consistent and superior product that stands in stark contrast to the often-varied condition of the existing rental stock.

Beyond the physical attributes of the apartments themselves, the BTR model introduces a more holistic, service-oriented approach to housing that focuses on community and lifestyle. These developments are designed to foster a sense of belonging by incorporating extensive amenities such as communal lounges, state-of-the-art fitness centers, co-working spaces, rooftop terraces, and even pet-friendly facilities. A dedicated on-site management team is a hallmark of the model, providing residents with a single point of contact for everything from maintenance requests to community event coordination. This integrated approach not only elevates the standard of living for residents but also introduces a new paradigm to the rental market. It transforms an apartment building from a mere collection of individual units into a vibrant, managed community, setting a higher bar for the entire industry and reshaping tenant expectations of what a rental experience can and should be.

Market Realities and Growth Catalysts

A Niche Market with Premium Positioning

Despite its transformative potential and rapid growth, it is important to recognize that the build-to-rent sector currently operates as a small and predominantly premium segment of the broader Australian housing market. The vast majority of BTR projects that have been completed to date are positioned at the upper end, with rental prices typically set well above the local median for comparable properties. This premium is justified by the higher quality of the buildings, extensive amenity offerings, and professional management services included. However, this positioning means that the immediate benefits of this higher-quality, professionally managed rental stock are predominantly flowing to higher-income tenants who can afford the associated costs. While the model brings much-needed quality and choice to the market, its current affordability profile limits its direct impact on easing rental stress for low and middle-income households, a critical challenge in Australia’s major cities.

The sector’s most significant limitation at present is its scale. BTR accounts for well under 1% of Australia’s total rental housing supply, a figure that underscores its nascent stage of development. Even with a robust pipeline of new projects, its market share is projected to remain a small fraction of the overall market for the foreseeable future. Industry analysis emphasizes that the living sector will function as a “complement, not a substitute,” for the prevailing rental supply model, where over 83% of renters continue to lease from small-scale private investors. Geographically, the sector’s early growth has been heavily concentrated in Melbourne and Sydney, which together account for approximately two-thirds of all completed and planned BTR projects. When viewed in an international context, the immaturity of Australia’s market becomes clear. In established markets like the United Kingdom and the United States, institutional ownership of rental properties is more than ten times higher, highlighting the substantial headroom for growth in Australia if supportive policy and capital conditions persist.

The Investor Perspective: Strong Performance and Policy Tailwinds

The attraction for investors is multifaceted, clear, and underpinned by robust performance metrics that have solidified the sector’s appeal. Existing BTR projects across Australia are reporting exceptionally high occupancy rates, consistently falling between 95% and 98%, which indicates strong and sustained tenant demand. These properties are also leasing up at an accelerated pace, often absorbing 30 to 40 apartments per month, far quicker than traditional for-sale projects. Furthermore, they are demonstrating steady annual rental growth of around 5%, providing a reliable and growing income stream for investors. This strong performance has attracted significant offshore interest, particularly from institutional investors in Japan, Singapore, South Korea, North America, and the Middle East. These global players are eager to gain exposure to a mature economy with a well-documented structural shortage of rental housing, viewing the Australian BTR market as a prime opportunity for long-term, stable returns.

The rapid growth of the BTR sector has been critically enabled by a series of supportive government reforms and favorable economic conditions. Key changes to Managed Investment Trust (MIT) tax rules have been instrumental, making large-scale residential investment more financially viable by aligning the tax treatment with other forms of commercial real estate. Concurrently, the formal recognition of BTR as a distinct asset class in state and local planning regulations has helped to streamline the approval process and unlock necessary financing from lenders who now have greater certainty about the model. With construction costs beginning to stabilize after a period of significant volatility, investor returns are expected to improve further, encouraging more capital to enter the market. This confluence of strong market fundamentals, a supportive policy environment, and improving economic conditions has created a fertile ground for the sector’s continued expansion.

A New Foundation for Australian Renting

Ultimately, while the build-to-rent sector began as a small-scale component of the housing market, its potential was immense and widely recognized. It was viewed as a positive and necessary development that introduced new sources of institutional capital, improved consistency in the rental experience, and brought a new level of scale to a system long reliant on fragmented ownership. Governments saw its potential as a partial solution to persistent housing supply challenges, while investors identified a market at the nascent stage of a long and promising growth cycle. The living sector was poised to add critical depth, choice, and quality to Australia’s rental landscape, having successfully reshaped expectations and set new standards for years to come.