A recent handshake between a Missouri-based national contractor and an Oregon-based regional specialist is sending ripples across the country, signaling a significant shift in how America plans to rebuild its most vital, yet often invisible, infrastructure. In a strategic move announced on January 23, national water and wastewater contractor Garney acquired Emery & Sons Construction Group, a heavy civil and underground utility expert from Salem, Oregon. While the financial details remain private, the implications of this acquisition extend far beyond corporate balance sheets, offering a blueprint for addressing the nation’s pressing water system challenges and highlighting a new era of industry consolidation. This deal is not merely a regional transaction; it is a microcosm of the larger forces reshaping the construction landscape, from persistent labor shortages to the unprecedented demand for infrastructure renewal.

When a Contractor in Missouri Buys One in Oregon Why Should Communities Pay Attention

The acquisition of a regional specialist by a national powerhouse represents more than a simple expansion of a corporate map; it is a calculated response to the growing complexity of modern infrastructure projects. Garney, a Kansas City-based firm with a nationwide presence, did not just buy a company; it strategically integrated a well-established local expert with nearly 60 years of deep-rooted knowledge in the Pacific Northwest. This move allows a national entity to operate with the agility and insight of a local partner, a hybrid model essential for navigating the unique geological, regulatory, and community landscapes of different regions.

This approach signifies a broader industry evolution where scale meets specialization. National firms are increasingly recognizing that to effectively compete for and deliver on the multibillion-dollar infrastructure projects emerging across the country, they need more than just capital and equipment. They require the specialized skill sets, established relationships, and experienced workforce that regional leaders like Emery & Sons possess. The combination creates a single-source entity capable of managing projects from conception to completion, reducing inefficiencies and providing project owners with a more reliable and accountable partner.

The Pressing Need for a National Investment in Aging Water Systems

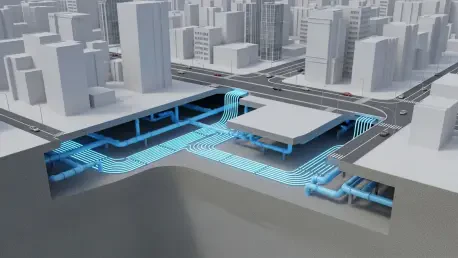

Across the United States, a quiet crisis is flowing through millions of miles of aging pipes. Many of the nation’s water and wastewater systems were built generations ago and are now approaching the end of their functional lifespan, leading to an increasing number of water main breaks, service disruptions, and public health concerns. The American Society of Civil Engineers has consistently highlighted the significant “investment gap” between the funding needed to modernize these systems and the actual amount being spent. This long-overdue reckoning with deferred maintenance has created an urgent and powerful demand for comprehensive infrastructure upgrades.

In response, communities from coast to coast are beginning to allocate substantial resources toward renewing their critical water infrastructure. This surge in investment, bolstered by federal initiatives, has created a robust and highly competitive market for contractors with the expertise to execute these complex projects. The Garney-Emery deal is a direct reflection of this market reality. It positions the consolidated firm to capitalize on the sustained demand by offering a comprehensive suite of services tailored to the large-scale, multifaceted water projects that are becoming the new norm.

Analyzing the Blueprint of the Garney and Emery Acquisition

A primary driver behind this acquisition was establishing a permanent and formidable presence in the Pacific Northwest, a region identified as a key long-term growth market. Rather than attempting to build a presence from the ground up, a process that can take years, Garney opted for a strategic integration. The acquisition of Emery & Sons provides an instant foundation, complete with an established reputation, existing client relationships, and a fleet of specialized equipment already deployed in the region. This “plug-and-play” approach enables Garney to immediately compete for major projects with the credibility of a long-standing local entity.

Furthermore, the deal significantly expands Garney’s service arsenal by incorporating the specialized capabilities of Emery & Sons. The Oregon-based firm brings deep expertise in earthwork, underground utilities, and the installation of large-diameter transmission and distribution pipelines, which are critical components of major water infrastructure undertakings. By bringing these services in-house, Garney enhances its capacity to self-perform a greater portion of its projects. This vertical integration not only improves cost control and project scheduling but also strengthens its value proposition as a full-service provider capable of tackling more intricate civil and municipal projects as a single, cohesive unit.

An Insiders View on Industry Pressures and Long Term Vision

According to Garney’s CEO, David Burkhart, the decision was guided by a long-term vision rather than short-term financial gains. He emphasized that communities nationwide are making historic investments to upgrade and maintain their water systems for future generations. This sustained demand requires reliable partners who can deliver complex projects successfully. The acquisition was framed as a proactive measure to meet this growing need, ensuring the company has the right resources and expertise in the right places to serve a market that is expanding in both size and complexity.

Burkhart also pointed to a critical industry-wide challenge: the persistent shortage of skilled labor. In today’s construction market, acquiring a company is often as much about acquiring talent as it is about acquiring assets. By bringing Emery & Sons into the fold, Garney gained not just physical equipment but, more importantly, a proven craft workforce and an experienced field leadership team. This strategic acquisition of human capital provides a significant competitive edge, ensuring that the company has the necessary personnel to maintain its standards of quality and reliability while offering long-term career opportunities to its expanded employee base.

A Bellwether for Broader Construction Industry Trends

This deal is emblematic of a powerful consolidation wave sweeping through the construction sector. As projects become larger and more technologically advanced, smaller to mid-sized firms can find it challenging to compete for top-tier contracts. Consequently, mergers and acquisitions have become a primary strategy for ambitious companies seeking to rapidly expand their geographic footprint, diversify their service offerings, and achieve the scale necessary to bid on and execute major infrastructure programs. The Garney-Emery transaction is a textbook example of this trend in action within the specialized water sector.

Beyond market expansion, the acquisition serves as a modern playbook for addressing the industry’s chronic labor shortages. Instead of relying solely on traditional recruitment, which is often slow and insufficient, companies are turning to strategic acquisitions as a highly effective tool for talent acquisition. This approach allows a firm to onboard an entire team of vetted, experienced professionals in a single transaction. In an era where skilled labor is one of the most valuable and scarce commodities, using M&A to secure a dedicated workforce has become a critical component of a successful long-term growth strategy.

The fusion of Garney and Emery & Sons represented a strategic alignment with the powerful undercurrents shaping the future of American infrastructure. It demonstrated how national reach could be powerfully combined with local expertise to create a more resilient and capable entity. Ultimately, the acquisition was a clear indicator of how the construction industry was adapting to meet one of the nation’s most fundamental challenges: the urgent need to rebuild its water systems. The move served as a forward-looking model for growth, talent acquisition, and service delivery in an increasingly demanding market, setting a precedent for how complex, large-scale projects might be tackled in the years that followed.