In a landscape marked by economic fluctuations, rising interest rates, and policy ambiguities, the U.S. industrial real estate sector stands as a beacon of resilience, continuing to attract significant investment and maintain robust fundamentals despite broader uncertainties casting shadows over many industries. This sector has managed to carve out a path of stability, driven by consistent sales volumes and steady pricing. National sales figures for the first half of the year reached an impressive $33.8 billion, with properties trading at an average of $129 per square foot—a level that mirrors pricing stability seen in recent times. This steadfast performance, even as deal flow faces headwinds from cautious investor sentiment, raises intriguing questions about the forces propelling this market forward. As economic challenges persist, the industrial sector’s ability to hold firm offers a compelling case study in adaptability, with localized demand and evolving market dynamics playing pivotal roles in sustaining investor confidence.

Unpacking Investment Trends and Market Stability

Delving deeper into the investment landscape, the industrial real estate market showcases a remarkable ability to weather economic storms through sustained activity and pricing consistency. The $33.8 billion in sales volume recorded in the first half of the year underscores a strong appetite for industrial assets, particularly in high-demand regions like the West Coast and Mid-Atlantic. Logistics and manufacturing properties, in particular, have driven high-value transactions, reflecting the sector’s appeal to investors seeking safe havens amid uncertainty. Even as concerns over interest rates and ambiguous tariff policies temper deal flow, optimism is brewing with expectations of potential rate cuts and clearer regulations on the horizon. This cautious yet hopeful outlook suggests that the sector could see an uptick in activity if economic conditions align favorably. Moreover, the stability of property pricing at $129 per square foot serves as a reassuring signal to stakeholders, highlighting how the industrial market remains a reliable cornerstone for investment portfolios navigating turbulent times.

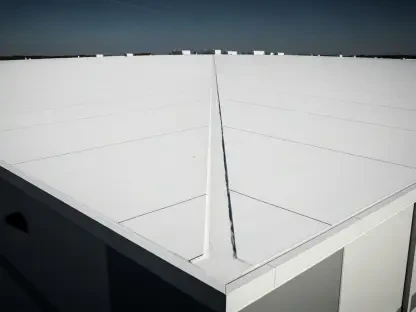

Rental Growth, Vacancy Shifts, and Future Outlook

Shifting focus to operational metrics, rental growth emerges as a key indicator of the industrial sector’s vitality, with national in-place rents climbing to $8.63 per square foot, marking a 6.1 percent increase year-over-year. Markets like Philadelphia have outpaced others, boasting a 9.2 percent growth rate fueled by expanding port and logistics infrastructure. However, this positive trend is tempered by a national vacancy rate that has edged up to 9.1 percent, largely due to a surge of new supply entering the market. This influx has subtly shifted leverage toward tenants, narrowing the gap between new lease rates and existing rents to $1.45 per square foot. Meanwhile, development activity remains robust yet cautious, with 340 million square feet under construction as of mid-year, though rising vacancies and tighter lending conditions have slowed planned projects. Looking back, the sector demonstrated resilience by balancing supply and demand dynamics effectively. Moving forward, stakeholders should monitor economic indicators closely, as potential improvements could unlock further growth, while regional strengths in technology and logistics hubs offer tailored opportunities for strategic investment.