The analysis of the used construction equipment market in the United States for August 2024 reveals a detailed picture of shifting inventory and value trends across various segments. This comprehensive examination delves into the nuances of heavy-duty, medium-duty, and lift equipment, offering insights into the forces driving changes in supply and demand.

Heavy-Duty Equipment Market Dynamics

Inventory Changes and Value Fluctuations

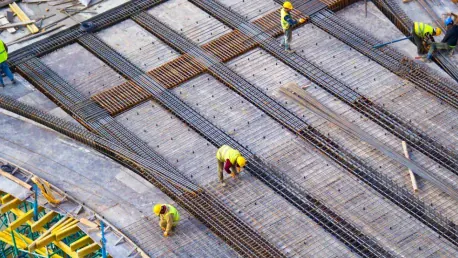

In the heavy-duty construction equipment sector, significant inventory increases were recorded for various machinery. Notably, the overall inventory surged by 2.48% month-over-month (M/M) and a significant 20.86% year-over-year (Y/Y). Wheel loaders were particularly noteworthy, with inventory climbing by 3.22% M/M and a staggering 31.65% Y/Y. This substantial growth in supply indicates that there is a high availability of heavy-duty machinery, suggesting possible overstock situations for suppliers.

Despite the inventory build-up, the asking values for heavy-duty equipment saw a notable decline, dropping 1.26% M/M and 5.59% Y/Y. Auction values mirrored this downward trend, decreasing by 1.64% M/M and 10.36% Y/Y. This decline in value amidst rising inventory points towards a softening market where the influx of equipment has diluted demand, putting downward pressure on prices. For stakeholders, whether buyers or sellers, these dynamics underline the importance of understanding market saturation levels and adjusting pricing strategies accordingly.

Implications for Stakeholders

The pronounced increase in inventory combined with falling values has significant implications for various stakeholders. Suppliers and dealers may face challenges in moving excess inventory at desired price points, necessitating aggressive marketing or promotions. On the other hand, buyers find themselves in a favorable position, with more options available at potentially lower prices.

For construction companies looking to expand their fleets or replace aging equipment, now might be an optimal time to negotiate deals. However, the continuing decline in equipment values might signal wider economic trends or shifts in the construction industry, which stakeholders should monitor closely. The heavy-duty segment’s current state serves as a barometer, reflecting broader market health and offering predictive insights into future market behaviors.

Medium-Duty Equipment Market Trends

Inventory Growth

The medium-duty equipment market also witnessed noticeable inventory increases in August 2024. Segments such as skid steers, loader backhoes, and mini excavators saw substantial growth. Specifically, inventory levels for these items increased by 3.01% M/M and an astounding 42.68% Y/Y. Track skid steers, in particular, demonstrated remarkable expansion with a 1.9% M/M and a 53.61% Y/Y increase in inventory.

Loader backhoes also showed significant growth, with inventory climbing by 9.82% M/M and 19.79% Y/Y. This marked rise in medium-duty inventory, akin to the heavy-duty segment, suggests that suppliers have been steadily building up stocks, possibly in anticipation of higher demand. However, the comprehensive boost in availability across these types of machinery may signal potential shifts in market demands and operational needs.

Decline in Values

While inventory rose, asking and auction values in the medium-duty segment trended downward. Asking values decreased by 0.68% M/M and 7.07% Y/Y, while auction values fell by 0.96% M/M and 10.7% Y/Y. This concurrent decline in values despite increasing inventory suggests that demand is not keeping pace with supply.

For buyers, the environment remains advantageous, echoing sentiments seen in the heavy-duty segment. However, sellers might need to recalibrate their pricing and marketing strategies to attract more buyers, possibly by highlighting value propositions or offering financing incentives. For the industry at large, these moves might help balance the supply-demand scales and stabilize the market more effectively.

Lift Equipment Market Analysis

Inventory and Value Trends

Lift equipment experienced significant inventory boosts as well, with August 2024 showing a 7.9% M/M and 17.03% Y/Y increase. This pronounced inventory uptick is reflective of similar trends in the heavy and medium-duty segments. However, unlike the consistent depreciation seen in the other categories, lift equipment showed a nuanced value trend.

Asking values for lift equipment registered a slight M/M decrease of 0.03% and a more notable 10.37% Y/Y drop. Interestingly, auction values for lift equipment in August demonstrated a subtle increase of 0.48% M/M, though they were down 15.69% Y/Y. The slight uptick in auction values M/M suggests a potential stabilization or minor rebound within this segment, although the overarching theme still indicates a general decrease in equipment value over the year.