The construction and industrial sectors are poised for a technological revolution as Ironspring Ventures, an Austin, Texas-based investment firm founded in 2020, spearheads this transformation. Recently, Ironspring Ventures unveiled its second fund, a $100 million investment focused on catalyzing innovation in construction and industrial technologies. This initiative seeks to address numerous challenges currently plaguing the industry, such as high material costs, labor shortages, and outdated infrastructure. By focusing on these critical pain points, Fund II aims to drive significant advancements and foster a more resilient and efficient construction ecosystem.

Addressing Industry Pain Points

Industry-specific pain points have driven Ironspring Ventures to double down on their investment strategy, with a mission that is crystal clear: by injecting capital into innovative startups, they hope to facilitate the development of technology-driven solutions that can effectively mitigate these issues. High material costs and labor shortages are two of the most pressing challenges, and Ironspring Ventures aims to provide the necessary tools for combating them through automation and advanced supply chain management. Their strategic investments are designed to target these specific problems, not only supporting burgeoning startups but also paving the way for broader industry improvements.The strategy revolves around investing in companies that offer practical, scalable solutions to real-world problems, thereby fostering a more efficient and resilient construction ecosystem. For instance, by addressing the inefficiencies in supply chain management and outdated operating systems that are currently hindering industry progress, Ironspring Ventures is setting the stage for a wave of technological adoption that can streamline operations and enhance productivity. This focused approach underscores the firm’s commitment to resolving the most critical challenges the industry faces today, driving long-term transformation through strategic investment in cutting-edge technologies.

Evolution from Fund I to Fund II

Ironspring Ventures initially launched with a $61 million Fund I, which was successfully deployed to support 16 companies specializing in construction and industrial technologies. Fund I’s focus was on identifying and nurturing startups capable of addressing significant operational challenges within the industry. These initial investments laid the groundwork for the more ambitious Fund II, signaling an expanded commitment not only in financial terms but also in the scope of their strategic investments. With the launch of the $100 million Fund II, Ironspring Ventures aims to accelerate technological adoption in construction and industrial sectors, furthering industry advancements with expanded resources.This second fund will continue to target the same sectors but with a broader mandate and increased resources, aiming to enable technological solutions that tackle key pain points more effectively. The strategic shift from Fund I to Fund II also highlights Ironspring Ventures’ evolved approach, moving from laying initial groundwork to now fully leveraging innovative startups for maximum industry impact. The increased financial commitment allows for deeper engagement with startups that meet the critical needs of the construction ecosystem, from automation technologies to supply chain enhancements, ultimately positioning the industry for substantial efficiency gains and operational improvements.

Highlighted Startups and Technological Solutions

The new fund is set to invest in a diverse array of startups initially focusing on manufacturing and supply chain solutions, with four notable startups poised to benefit first: Goodship, Base Power, Wilya, and Cargado. Goodship, an AI-driven freight orchestration platform, provides performance analytics to optimize distribution networks, addressing long-standing inefficiencies in logistics. Base Power, based in Austin, offers sustainable energy solutions through its battery backup services and monthly power supply options, contributing to a cleaner and more reliable power infrastructure.New York City’s Wilya is revolutionizing workforce management by creating flexible, on-demand talent pools for manufacturers, thereby easing labor shortages that plague the industry. Chicago’s Cargado focuses on enhancing security, transparency, and engagement in cross-border logistics, ensuring smoother and more secure supply chain operations. Each of these startups exemplifies the kind of innovative solutions Ironspring Ventures aims to support through Fund II, underscoring the firm’s commitment to driving meaningful improvements in key operational areas within the industry.

Success Stories from Fund I

The success of Fund I can be observed through several key investments that have made significant strides in the industry. Document Crunch, for instance, leverages generative AI to streamline contract management, providing a practical solution to one of the most tedious aspects of construction project management. This technology not only simplifies the legal complexities but also enhances efficiency by automating responses to contract-related inquiries. Handle, another notable startup, offers comprehensive credit management and payment processing solutions, helping contractors and material suppliers manage their finances more effectively and reduce payment delays.Join, another standout from Fund I, enables better documentation and tracking of early planning decisions in construction projects. By facilitating collaborative input from various stakeholders, Join makes it easier to manage project costs and timelines, ensuring that projects stay on track and within budget. These startups are just a few examples of how targeted investment from Ironspring Ventures can lead to meaningful industry advancements. The success stories from Fund I highlight the positive impact that strategic, technology-focused investments can have on overcoming the operational inefficiencies that have long challenged the construction sector.

Economic Context and Contech Funding Trends

The broader economic landscape for construction technology (contech) has been challenging, with a noted decline in funding seen recently. In 2023, contech funding dropped by 44% to $3 billion, down from $5.4 billion in 2022. Despite this decline, signs of stabilization and recovery are emerging, highlighted by a 20% growth in contech funding in the first quarter of 2024. This backdrop makes the launch of Ironspring Ventures’ Fund II particularly significant, as it underscores the firm’s confidence in the potential for technological innovation to overcome economic and operational challenges within the construction industry.By strategically deploying capital at this juncture, Ironspring Ventures aims to drive long-term industry transformation, capitalizing on the current momentum toward recovery and growth. The timing of this investment fund aligns with a broader industry movement towards integrating more sophisticated technologies capable of addressing entrenched inefficiencies. Ironspring Ventures is positioning itself to be a key player in this transformative period, leveraging its financial resources and strategic foresight to foster innovation that can lead to lasting improvements in construction and industrial operations.

Strategic Focus on Automation and Data-Driven Solutions

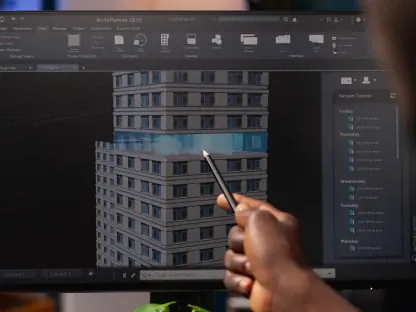

A prominent theme in Ironspring Ventures’ investment strategy is the emphasis on automation and data-driven solutions. As the construction industry grapples with labor shortages and inefficiencies, the role of technology in streamlining operations becomes increasingly vital. Startups specializing in AI, machine learning, and automation are at the forefront of this transformation, offering solutions that enhance various aspects of construction, from project planning and execution to supply chain management and workforce allocation. These technologies promise to elevate the efficiency and productivity of construction projects, ultimately driving down costs and improving outcomes.By leveraging data and automation, construction companies can achieve higher levels of efficiency, reduce costs, and enhance project outcomes. Ironspring Ventures’ focus on these cutting-edge solutions underscores their commitment to driving meaningful industrial advancements. The firm’s strategic investments in innovative startups that embody these technologies are poised to deliver significant improvements in productivity and operational efficiencies. As these solutions are adopted more broadly across the industry, the potential for Ironspring Ventures to contribute to a lasting transformation becomes increasingly evident, solidifying their role as a catalyst for technological innovation within construction.

Broader Implications and Future Prospects

The construction and industrial sectors are on the brink of a technological revolution, largely driven by Ironspring Ventures. Founded in 2020 and based in Austin, Texas, this investment firm is now steering a transformative wave. Notably, Ironspring Ventures has recently introduced its second fund—a substantial $100 million investment—dedicated to sparking innovation within construction and industrial technologies. This ambitious initiative aims to tackle pressing challenges that have long hindered these sectors, such as spiraling material costs, persistent labor shortages, and antiquated infrastructure. By targeting these pivotal issues, Fund II sets the stage for considerable advancements that promise to enhance the resilience and efficiency of the construction ecosystem. The investment not only strives to resolve immediate problems but also envisions creating a more sustainable and future-ready industry landscape. With such a focused strategy, Ironspring Ventures is laying the groundwork for a modernized and efficient construction sector capable of adapting to evolving demands.