The establishment of Banco John Deere, a joint venture between Deere & Company and the Brazilian bank Bradesco, stands to revolutionize financing for agriculture and construction equipment in Brazil. This strategic collaboration marks a key development in the country’s financial landscape, promising enhanced access to necessary machinery and support for essential economic sectors.

The Genesis of Banco John Deere

Joint Venture Formation

Banco John Deere emerges from a balanced 50:50 partnership between Deere & Company and Bradesco, each bringing distinct strengths to the table. Deere & Company, renowned for its expertise in agricultural and construction equipment, pairs with Bradesco’s robust knowledge of financial services to form a synergetic platform. This joint venture aims to effectively cater to the niche requirements of Brazilian farmers and construction businesses. By combining their capabilities, both entities aspire to provide seamless and innovative financial solutions tailored specifically to the needs of these critical sectors.

The collaboration between Deere and Bradesco is engineered to capitalize on Brazil’s thriving agriculture and construction markets. The JV is designed not just as a financial service provider but as a strategic partner to these industries. Deere’s decades-long experience in creating durable, efficient machinery, and Bradesco’s extensive local financial network are expected to provide a comprehensive suite of services. Moreover, this alliance intends to offer more than just financing; it aims to supply essential business tools that can drive efficiency and productivity in these sectors.

Strategic Importance to Brazil

The joint venture underscores the pivotal roles that agriculture and construction play in Brazil’s sprawling economy. By offering tailored financial solutions, Banco John Deere is positioned to greatly enhance these sectors, thereby fueling overall economic growth. The investment in this initiative demonstrates a robust commitment by both companies to cement their presence in these vital economic areas. These sectors are not just important growth engines but essential stabilizers of the national economy, providing employment and supporting numerous ancillary industries.

The focus on enhancing financial services within these sectors highlights the strategic importance Deere & Company and Bradesco place on both agriculture and construction. These industries are essential to Brazil’s socio-economic fabric, contributing significantly to GDP and employment. Enhanced access to capital will enable farmers and construction firms to invest in modern, efficient equipment, ultimately leading to increased productivity and economic sustainability. This strategic infusion of financial resources is aimed at driving modernization in practices, thereby making Brazilian agriculture and construction more competitive on the global stage.

Enhanced Financial Services

Diversified Financing Options

Banco John Deere is poised to diversify and expand the array of financial services available to the Brazilian market, covering equipment, parts, and services. The inclusion of innovative subscription-based offerings is particularly noteworthy as it introduces flexibility and adaptability to the financing process. This approach is aimed at making financial products more accessible, aligning with the varying needs of customers. By providing a broader spectrum of options, Banco John Deere seeks to meet the distinct and evolving financial requirements of farmers and construction businesses.

Offering a variety of financing solutions enables Banco John Deere to cater to a wider clientele. From traditional loans to leasing options and the new subscription-based models, the joint venture aims to offer something for every type of customer. These diversified financial products mean customers can choose what suits their business cycles and cash flows best. Such flexibility is particularly crucial in sectors marked by seasonal activities and fluctuating demands. Diversification in such services can also act as a catalyst for technological adoption, enabling businesses to upgrade their equipment regularly without enduring massive upfront costs.

Customer-Centric Solutions

Central to Banco John Deere’s service offerings is a customer-centric approach designed to address the specific needs and challenges faced by farmers and construction firms. This focus is intended to foster customer loyalty and improve satisfaction, making it easier for businesses to operate and expand. By understanding the unique pain points and requirements of their customers, both Deere & Company and Bradesco aim to provide financial services that are not only efficient but also highly responsive to user needs. This dedicated focus on the customer experience is likely to position Banco John Deere as a trusted partner in its sectors.

The emphasis on a customer-centric model reflects a broader commitment to transforming the financing experience. Banco John Deere’s services are designed to be straightforward and accessible, eliminating much of the red tape traditionally associated with financial lending. This operational transparency, coupled with responsive service, aims to engender trust and reliability among customers. By prioritizing customer satisfaction, Banco John Deere hopes to build long-term relationships that encourage repeated business and positive word-of-mouth, ultimately fostering a sense of community and support within the Brazilian agriculture and construction industries.

Leveraging Technological Integration

Streamlining Processes

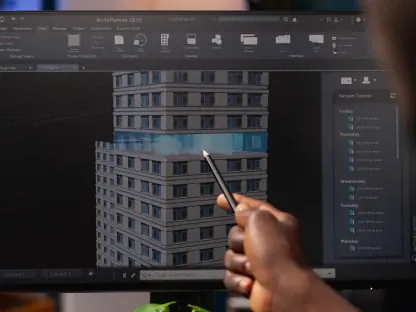

The joint venture plans to incorporate advanced, user-friendly technology to streamline its service provisions. By digitizing and automating various processes, Banco John Deere aims to reduce the time and effort required for customers to access financial services. This technological integration reflects a broader trend toward digital transformation currently sweeping through both the financial and equipment sectors. The adoption of digital methodologies is expected to enhance operational efficiencies, making financial transactions smoother and less cumbersome for users.

Technology’s role in this venture cannot be understated. Automated systems and digital platforms will likely minimize human errors and speed up approval processes. For instance, digital loan applications can reduce the wait time for approvals from weeks to mere days, providing customers with quicker access to crucial funding. This shift towards digital solutions also means real-time updates and easier access to information for customers, enabling them to make well-informed financial decisions. The use of state-of-the-art technology is not merely a step towards modernization but a strategic initiative aimed at enhancing customer satisfaction.

Enhancing User Experience

The integration of cutting-edge technology is also intended to significantly enhance the overall user experience. Customers will inevitably find it easier to navigate financing options, apply for loans, and manage their accounts through intuitive digital interfaces. This technological shift is designed to facilitate greater customer engagement and satisfaction. User-friendly platforms will provide real-time support and feedback, creating a more interactive and responsive relationship between the financial institution and its clients. This focus on enhancing user experience aligns well with the broader industry trend of digital empowerment.

Intuitive digital interfaces and user-friendly applications represent a significant upgrade from traditional financial processes. These platforms are aimed at making interactions more seamless and less time-consuming. Whether it’s applying for a loan, checking account statuses, or understanding financing terms, the digital tools provided by Banco John Deere promise to make these tasks more straightforward. Enhanced user experience also means customizable interactions, where customers can set preferences for updates and notifications, ensuring they stay informed without being overwhelmed. This personalized approach is in line with modern customer service trends, emphasizing convenience and satisfaction.

Commitment to the Brazilian Market

Statements of Intent

Both Deere & Company and Bradesco have made public commitments to transforming the financing landscape in Brazil. Jorge Sivina, John Deere’s regional managing director, and José Ramos Rocha Neto, Bradesco’s vice president, have emphasized the importance of improving financing options and fostering economic growth in their statements. These pledges solidify the joint venture’s efforts to support Brazilian farmers and construction businesses. By making these commitments public, both leaders are signaling their intent to drive meaningful change in the sectors they serve, intensifying their focus on customer satisfaction and sectorial growth.

These public statements demonstrate a clear intent to be more than just financial service providers. They signify an active role in driving industry practices and standards to new heights. By voicing their commitment to Brazil’s developmental agenda, leaders from both companies are aligning their business strategies with national economic goals. This alignment should not only help in gaining public trust but also in attracting more business partnerships and collaborations. Their dedicated statements serve to assure stakeholders that Banco John Deere is invested in the long-term success of Brazil’s crucial agricultural and construction sectors.

Strengthening Market Position

By establishing Banco John Deere, the joint venture aims to secure a stronger foothold in the Brazilian market. This initiative allows both companies to combine their expertise and resources to offer more comprehensive and effective financial solutions. The strengthened market position is expected to translate into increased investments in agriculture and construction equipment, consequently driving industry growth. Building a strong market presence is instrumental for Banco John Deere in making a significant impact and achieving its strategic objectives within these crucial sectors of the Brazilian economy.

Combining forces allows Deere & Company and Bradesco to present a unified front, thus amplifying their market influence. This cohesive approach ensures a more extensive reach and impact on Brazil’s agricultural and construction sectors. Market strength often leads to competitive advantages, and in this case, it will likely translate into better financial terms and options for customers. Strengthening their position in the market also allows for better customer retention strategies, as customers are more likely to stay with a provider that offers reliable, innovative, and comprehensive financial solutions. This market empowerment strategy aims to ensure a long-lasting, positive impact on Brazil’s economic landscape.

Economic Impact and Prospects

Stimulating Investments

Banco John Deere’s enhanced financing solutions are expected to stimulate investments in cutting-edge agricultural and construction machinery. By making it easier for businesses to access crucial financing, the joint venture can encourage the modernization and efficiency of these sectors, contributing to broader economic development. Improved access to funds will enable businesses to adopt more efficient, state-of-the-art machinery, resulting in increased productivity and competitiveness. These advancements are likely to have a cascading effect on related industries and services, further amplifying the economic benefits of this initiative.

Facilitating investments in technological advancements is crucial for driving growth in the agriculture and construction industries. By offering a range of tailored financial products, Banco John Deere will likely play a key role in enabling businesses to transition from outdated machinery to advanced equipment. This transition is necessary for improving productivity, reducing costs, and maintaining competitiveness on a global scale. The prospect of easier access to modern machinery through varied financing options promises to be a game-changer for many small and medium-sized enterprises in these sectors, propelling overall industry growth and sustainability.

Long-Term Benefits

The launch of Banco John Deere, a joint venture between Deere & Company and the Brazilian bank Bradesco, is set to redefine financing for agriculture and construction equipment in Brazil. This strategic alliance represents a significant development in Brazil’s financial sector, aiming to provide better access to essential machinery and support for the country’s vital agricultural and construction industries.

Brazil’s agriculture and construction sectors are critical to its economy, driving employment and contributing to GDP growth. Historically, farmers and construction firms have faced challenges in securing affordable, efficient financing options for necessary machinery. This collaboration between two industry giants promises to mitigate these issues by offering tailored financial solutions, streamlined processes, and potentially lower interest rates.

Banco John Deere will likely leverage Bradesco’s extensive local market expertise and Deere & Company’s global experience in manufacturing and equipment financing. By combining these strengths, the joint venture aims to serve as a robust financial institution, fostering growth and innovation in Brazil’s key sectors. This initiative underscores the importance of strategic partnerships in addressing localized financial challenges while promoting economic progress.